CLI MN Supporting Partners

These businesses and professionals have made a commitment to support the Collaborative Law Institute of Minnesota and furthering Collaborative Practice through time and financial support.

Platinum Partner

Rainbow Mortgage

Rainbow Mortgage, Inc. | Dave Jamison

952-405-2090 | Dave@RainbowMortgageInc.com

rainbowmortgageinc.com

Additional Details about Rainbow Mortgage

David Jamison has been a supporting partner of the Collaborative Law Institute of Minnesota since 2004. Dave was the Winner of the prestigious “Stu Webb Award” in 2019 for his efforts in assisting Divorcing Clients with home loan concerns as then navigate their divorce journey. Dave brings unique specialized knowledge to the Mortgage and Divorce process using his 10 years of underwriting experience to assist Collaborative clients with even the most complex of situations. Dave coordinates with the attorneys, financial neutrals and health care providers to ensure that outcome matches the goal! Give Dave a call to discuss your unique situation to receive the specialized knowledge and advice you deserve.

Weekly Video Messages from Rainbow Mortgage:

Sign-up to receive our weekly video message Mortgage & Divorce News Email Paris@rainbowmortgageinc.com

December 20, 2024 Happy Holidays- A message from your Sponsor

https://bbemaildelivery.com/bbext/?p=video_land&id=09f3ff98-8300-49c3-91f8-ea1476863244

December 4, 2024 This week Dave gives a quick update on the market and a gift that one of our lenders came out with today (potentially lower rates for anyone with a credit score of 720 or better) Dave also discusses what happens when your clients go over their limits on their credit cards!

https://bbemaildelivery.com/bbext/?p=video_land&id=43318cac-cd2f-4c3e-b964-d25c9b3b7931

November 27, 2024 This weeks addition of Mortgage and Divorce News is simple- Happy Thanksgiving everyone! https://bbemaildelivery.com/bbext/?p=video_land&id=a0deb52f-e6ba-455c-b8df-08305604f81b

October 23, 2024 It’s cold and rates are not behaving, thus bad hair day for Dave. In addition to your weekly market update, Dave discusses 3 ways that your clients who haven’t worked or don’t have an income can potentially get qualified for a home loan. https://bbemaildelivery.com/bbext/?p=video_land&id=afec1657-58ca-419e-b100-366de43bb9d3

September 26, 2024 Life is a journey, and while the path may be a bumpy road at times, it’s those twists and turns that lead us to the most rewarding destinations. https://bbemaildelivery.com/bbext/?p=video_land&id=a1929926-03c8-4902-9f3d-ef44db183449

September 19, 2024 In this week’s edition of Mortgage and Divorce News, Dave covers the major Fed announcement of a 50-basis point rate cut and its impact on your clients, mortgage rates, and the real estate market overall. He also highlights a no-cost service available to you and your clients. Lastly, for the Minnesota attorneys, Dave reminds you about the live seminar happening next Thursday in Edina—lunch included! https://bbemaildelivery.com/bbext/?p=video_land&id=799a84a7-54b2-44df-abc2-c7d25f77be49

September 11, 2024This week Dave updates you on the market and rate trends. In addition, you learn some valuable information regarding equity and how to use it to your clients’ benefit. https://bbemaildelivery.com/bbext/?p=video_land&id=ddcc8549-552c-4327-9e84-df057418452c

September 4, 2024 This week Dave discusses the Recent Jolts Report and the upcoming Labor reports and current rates…Dave also discusses how to get 3 months of support payments to qualify a client for a refinance or purchase into 45 days or less. https://bbemaildelivery.com/bbext/?p=video_land&id=58306d79-8ed0-4f9e-af0f-99b76a926829

August 28, 2024 | This week in Mortgage and Divorce news, Dave brings you the latest on interest rate trends for home loans and shares which upcoming reports could impact those rates. He also dives into the topic of marital liens, explaining how an incorrect equity buyout setup could negatively affect your client’s ability to secure the best rate. For our Minnesota followers, Dave extends a special invitation to a lunch-and-learn session—he’s bringing the food! https://bbemaildelivery.com/bbext/?p=video_land&id=ea4ec8ac-04e6-4e3c-bbb3-a752f9e9050b

August 21, 2024 | Dave discusses current rates and the direction we think they are heading and an exciting ChatGPT usage.

https://bbemaildelivery.com/bbext/?p=video_land&id=63c92018-8a67-4262-b060-e7b4e87f823b

August 14, 2024 | https://bbemaildelivery.com/bbext/?p=video_land&id=4bbe61f0-49de-4860-959c-a804507e7a91

August 7, 2024 | Timberrrrrrr! That is the sound of mortgage rates falling. This week Dave discusses the rates and where they are at currently and also provides you with a chart to see how mortgage backed securities have acted lately.

https://bbemaildelivery.com/bbext/?p=video_land&id=a8a6296f-1630-468e-8d3f-192b5795e5ee

July 31, 2024 | Mortgage and Divorce News for Attorneys and Financial Planners…This week Dave updates you on where rates are headed, as well as Rainbow Mortgage Incs’ ability to review and assist your clients with lower credit scores and help them increase the scores. https://bbemaildelivery.com/bbext/?p=video_land&id=c6ca16fa-aae9-4a72-8822-1aaf9e0bf7ed

July 24, 2024 | This week Dave updates you on the rates and the market and what the Fed is up to…Dave also discusses release of liability vs assumption and blended rates. If you have any questions please give Dave a call at 612-396-9216.

https://bbemaildelivery.com/bbext/?p=video_land&id=c53d04a9-2610-4443-9427-d0aa788cbc9d

July 10, 2024 | This week Dave discusses current market conditions and when a potential rate cut may come. Also, Dave talks about the benefits of debt consolidation, even when a client has a low interest rate already.

https://bbemaildelivery.com/bbext/?p=video_land&id=00c50b7a-6ae3-44cb-b055-6c2d8ffb7d39

July 3, 2024 | This weeks update Dave goes over current rates and provides three amazing tip for Divorce Professionals. https://bbemaildelivery.com/bbext/?p=video_land&id=90e6eb46-3669-4394-8ed4-23c3b6c8531d

June 26, 2024 | Mortgage and Divorce News…this week Dave talks about the global economy, jobs and credit score protection. https://bbemaildelivery.com/bbext/?p=video_land&id=80323eed-a9bc-4a3b-8289-a682239562b6

June 12, 2024 | Today Dave talks about the signs that economy may be slowing and how that is good for rates and discusses some tips on people that are getting divorced that are of retirement age. https://bbemaildelivery.com/bbext/?p=video_land&id=28134bf4-5416-47c9-b139-fa9a92b2408dhttps://bbemaildelivery.com/bbext/?p=video_land&id=28134bf4-5416-47c9-b139-fa9a92b2408d

June 5, 2024 | Dave discusses how to help your clients qualify for home loans and what happens when a party keeping a home loan and they don’t refinance the other spouse off the loan and miss a payment what happens. Also, finally good news on mortgage rates take a listen. https://bbemaildelivery.com/bbext/?p=video_land&id=95518720-f7e9-4bee-89cf-7f72310fbe51

May 29, 2024 | Daily update and Wisdom Wednesday

https://bbemaildelivery.com/bbext/?p=video_land&id=f7776302-a66d-44dc-9b66-b3936fe3bb65

May 22, 2024 | Market Update and Great New Product that Can help Our Divorcing Clients | https://bbemaildelivery.com/bbext/?p=video_land&id=7a895030-f2e8-4016-9af0-9702fb45165b

April 24, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=9d8eccaf-602e-44b4-9b7f-b455542e1575

April 10, 2024https://bbemaildelivery.com/bbext/?p=video_land&id=71813619-7bc7-425c-a9df-f98cf30796ba

April 3, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=451e7517-a4d4-4843-b9af-b1a9b840ba3e

Thank you to all our Minnesota Family Law Attorneys that stopped by our Booth Last week. It was great seeing everyone!

March 20, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=b3d2ee54-2b48-495d-a4b1-d6c4f31c8393

Attorneys in Minnesota attending the Family Law Institute make sure to watch until the end for Special Invitation Huge News about NAR Settlement that everyone needs to know Market update

March 13, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=7ab8e519-c91f-4620-8a59-de41f0198e0a

Check out the Rainbow Mortgage Inc 25th Anniversary Special for your clients!

March 6, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=4278a292-116c-405b-9b92-abed3f885613

February 28, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=abce3f22-b092-48bc-a8df-9f9a4fdccf38

February 21 https://bbemaildelivery.com/bbext/?p=video_land&id=b9251fe0-bc14-467c-8045-4e90231fbcf2

Displaced Homemakers and Single Parents A borrower may also be considered a first-time homebuyer if they are a ‘displaced homemaker’ or a single parent who has not had ownership on a primary residence in the last three years or only had joint-ownership with a spouse. For example, the borrower owned a home last year with a spouse. They have since separated (or divorced) and the borrower is now considered a single parent as they have a child.

In the event that a broker expresses that the borrower meets first time homebuyer status due to being either a displaced homemaker or single parent, the underwriter will escalate the loan to determine what is needed to document their status with the purpose of obtaining a first-time homebuyer benefit. The underwriter will not request information regarding if the borrower is a single parent unless the broker requests the borrower be document as a first-time homebuyer until this corner case.

February 14, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=8bbdce18-8775-4276-a6a6-e4f00e7ac312

February 7, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=d3bf9f4c-f63f-40a4-b2c3-5fcc5aecbbb9

50% Divorce Rate: Nearly half of all marriages in the United States end in divorce, making divorce a prevalent issue affecting many families.

Homeownership Rates: According to the U.S. Census Bureau, approximately 65% of households are homeowners. This statistic underscores the importance of understanding the implications of divorce on property ownership and mortgages.

Financial Impact of Divorce: On average, divorce reduces a person’s wealth by about 77%, according to a study published in the Journal of Sociology.

Mortgage Debt in Divorce: In a divorce, mortgage debt is often one of the largest financial obligations to navigate. According to a report by Experian, mortgage debt represents the largest debt category for Americans, averaging around $208,185 per borrower.

Effect on Credit Scores: Divorce can have a significant impact on credit scores. Research from Credit Karma indicates that individuals who go through divorce see an average credit score drop of 30 points.

Refinancing Challenges: After a divorce, refinancing a mortgage can be challenging. A study by the Urban Institute found that 20% of homeowners who attempted to refinance after a divorce were denied.

Home Equity Disputes: Disputes over home equity are common in divorce proceedings. According to a study by Zillow, disputes over home value occurred in 30% of divorces involving real estate.

Impact on Children: Divorce can have long-lasting effects on children. Research from the American Psychological Association suggests that children of divorced parents are more likely to experience emotional and behavioral problems.

Length of Divorce Proceedings: Divorce proceedings can be lengthy and costly. On average, divorce cases in the United States take about 11 months to finalize, according to data from the Centers for Disease Control and Prevention (CDC).

Rise of Gray Divorce: The phenomenon of “gray divorce,” or divorces among older adults, is on the rise. According to a study by the Pew Research Center, the divorce rate for adults ages 50 and older has doubled since the 1990s. This demographic may have unique mortgage and property ownership considerations.

January 31, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=d6bc9d89-49b1-4c22-a188-003347e71720

Big News Special Opportunity

January 24, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=235dfea6-be98-4591-b531-03293b019bb4

Check out the market update and two valuable tips for your divorce practices!

January 17, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=7924db94-1be2-4230-8728-aa560f90cc37

January 3, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=79044af0-537a-476b-927b-e6e8db487c75

This week Dave talks about rate and the market…and goes over a brief FHA synopsis and why it can be good for your clients.

January 1, 2024 https://bbemaildelivery.com/bbext/?p=video_land&id=39904654-0f92-448f-a0a7-5bcdf6f6508f

December 27, 2023 https://bbemaildelivery.com/bbext/?p=video_land&id=fe47af73-ddec-4fb4-8605-e461771c034a

December 21, 2023 https://bbemaildelivery.com/bbext/?p=video_land&id=ad12c72f-2cd2-471c-b4e4-860a8fce8490

Mortgage rates for the week have been mostly unchanged. Take a look at the chart below…you can see that we have a really solid floor of support on the Mortgage Backed Securities, which means some really bad news would have to occur for rates to move significantly worse. Tomorrow is the Personal Consumption and Expenditures report better known as PCE a good number tomorrow could allow us to continue the rise in mortgage backed securities and lower rates for the beginning of the New Year.

December 13, 20023

Flyer Link

Take a look at the flyer where Dave discusses the improvements in mortgage rates and introduces the new HELP program Rainbow Mortgage launched last week. Discover how it can benefit both you and your clients. We value your feedback, so please share your thoughts!

December 6, 2023 https://bbemaildelivery.com/bbext/?p=video_land&id=09349946-419c-428f-a32c-f1c054dbc87d

This week Dave gives a market update- good news finally for rates. In the divorce tip, Dave dispels the myth that your clients have to refinance in order to allow the non–occupying spouse to purchase a home.

November 29 https://vid.us/esote5

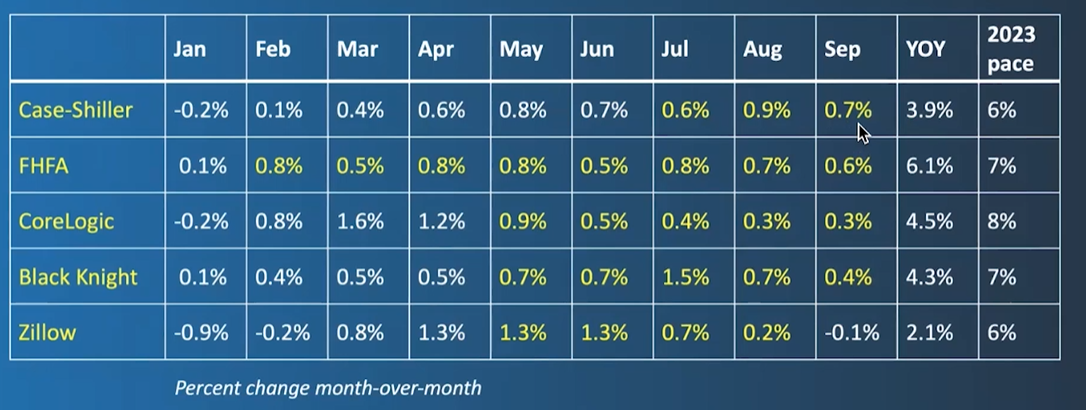

Dave covers the current mortgage rates and provides a helpful illustration. Additionally, below the video, there’s a home appreciation chart for the year that contains valuable information to share with your clients. In the mortgage segment, Dave delves into qualifying clients with 1099 income and self-employment, which is worth your attention. Lastly, Dave emphasizes their availability for addressing any queries regarding mortgage and divorce, offering a no-cost analysis and unlimited question support for both you and your clients.

December 6, 2023 https://bbemaildelivery.com/bbext/?p=video_land&id=09349946-419c-428f-a32c-f1c054dbc87d

This week Dave gives a market update- good news finally for rates. In the divorce tip, Dave dispels the myth that your clients have to refinance in order to allow the non–occupying spouse to purchase a home.

November 22, 2023 https://bbemaildelivery.com/bbext/?p=video_land&id=e9a419d7-b262-44b7-af19-55d4d36453e0

Quick Market update and special Holiday Message from Dave to Everyone

November 15, 2023 https://vid.us/kgkaq1

This week, Dave provides an update on the market and current interest rates. He then discusses when clients undergoing divorce can obtain pre-approval for a home loan, debunking a common myth in the process. Additionally, Dave introduces a tool called temporary buydowns, which could allow clients to access rates 1, 2, or potentially 3 percent lower than current market rates (specific terms and conditions apply—contact Dave at 612-396-9216 for precise details). Lastly, Dave reminds you of the invaluable offer to review your decrees for mortgage-related matters at no cost, ensuring that clients have the correct language to support their housing goals after the decree.

November 8, 2023 http://mbshighway.com/view/1IKa-lc

This week Dave details the interest rate market and FINALLY we had a good week and rates came down. Dave also provides you with an insight into the cost of your clients waiting versus purchasing or refinancing now…CLICK ON THE LINK BELOW THE VIDEO to see the chart. Finally, Dave discusses how he can assist your clients with less than perfect credit and how as a Broker he is different from the banks.

October 25, 2023 https://vid.us/n7pd6i This week Dave gives a quick market update and offers to run payment scenarios for you to get exact numbers for your budgets and decrees. In addition Dave, goes over how support payments are treated in the mortgage world Pre January 1 2020 and Post January 1 2020. Finally, Dave shares how authorized user accounts can affect your clients credit scores and how to use his soft credit pull option to evaluate estimated effects of removing a credit account.

October 18, 2023 https://vid.us/fivpi7 This week Dave discusses where rates are at today and offers to look at payment options for your clients so you have accurate information. In addition, Dave talks about the WARN report (see below) and how it may be a precursor to lower rates. Finally, Daves mortgage tip is about credit and the importance of discussing with your clients the need to continue to pay their bills.

October 11, 2023 https://vid.us/7o49wc This week Dave talks about that market over the last week. Dave also discusses the importance of knowing that all lenders are not created equal. Dave wraps up with a nice little appreciation chart that you can share with your clients.

October 4, 2023 https://vid.us/iy3zz0 This week Dave talks about the Fed Chairs just needed to be quiet for a while and let the market do its thing. In addition, Dave provides insight to a cool debt consolidation tool that he has. The tool might solve some of the budgeting issues your clients may be facing in this challenging economy.

September 27, 2023 https://vid.us/jwgfzs This week Dave discusses the impact of the Federal reserve meeting. Also Dave talks about the benefits of a Marital lien in lieu of a straight cash out refinance.

September 20, 2023 https://vid.us/m3e820 This week Dave talks about the outcome of the Fed Meeting today and the outlook going forward. Also, Dave discusses the 5 aspects of the credit score and how a divorce proceeding can affect the score. Finally, Dave lets you know about obtaining a soft credit pull with Rainbow Mortgage Inc and the benefits of the soft pull!

September 13, 2023 https://vid.us/2cpmjn This week Dave discusses the Fed and their take on inflation and for your tip, Dave talks about Marital liens and their benefits for your clients!

September 6, 22023 https://vid.us/k1dthe This week Dave gives a brief weather update in Minnesota (yuck) and market update. In addition, Dave shares with you how your clients can potentially purchase a home before selling the marital home using what is called a RECAST option once the marital home is sold.

August 30, 2023 https://vid.us/y1l3zn This week Dave discusses current rates and the market movers. Also Dave discusses the importance of specifying debt distribution and he provides and example spreadsheet. Finally, Dave reminds you of the no cost decree review service that Rainbow Mortgage Inc provides.

August 23, 2023 https://vid.us/rc7u0h This week Dave updates you on the market and rates (nice reversal yesterday) In addition, some key tips on closing credit cards and accounts and how it an affect credit scores. Also, Dave reiterates the importance of using a lender that uses soft pulls for credit.

August 16, 2023 https://vid.us/kmsdx2 Today Dave discusses where the market is at and some key elements of the mortgage backed securities market. Your divorce tips has to do with escrow refund checks and escrow set up fees and how to potentially free up some cash for a closing.

August 9, 2023 https://vid.us/0mlm0o This week Dave discusses the current rates and inflationary pressures on the mortgage backed securities market. Also, Dave addresses one of the biggest mistakes he sees divorcing clients make after divorce when they purchase a new home.

August 2, 2023 https://vid.us/0dxg2y This week Dave talks about the US Credit rating being downgraded and how that affected mortgage rates. Dave also discussed why a debt consolidation loan may be a better option than keeping that low first mortgage interest rate and some tools that Dave has that he can use to help you and your clients make educated decisions!

Gold Partner

OurFamilyWizard

OurFamilyWizard | Racheal Howitz

612-481-0164 | rhowitz@ourfamilywizard.com

ourfamilywizard.com

Additional Details about OurFamilyWizard

OurFamilyWizard applications help divorced or separated parents maintain an amicable path forward. On OurFamilyWizard, parents can manage schedules, record expenses, create journal entries, share files, and document communication accurately.

Working with clients on OurFamilyWizard, legal and mental health practitioners can assist families to move beyond conflict and co-parent with confidence.

Contact me to learn more about our fee waiver program, free professional access, and updated agreement language.

Professional Resource Kit Linked here: https://bit.ly/40CsrrS

Gold Partner

Strategic Mediation Solutions

Strategic Mediation Solutions | Brett Jensen

952-299-0008 | brett@sms-mn.com

www.strategicmediationsolutions.com

Additional Details about Strategic Mediation Solutions

Why Choose Us as Your Divorce Mediators in Minnesota?

Navigating divorce is one of life’s most challenging transitions. At Strategic Mediation Solutions, we provide a neutral, compassionate, and solutions-focused approach to help you move forward with clarity and confidence. Here’s why families choose us for their divorce mediation needs:

Collaborative Approach to Reach Marital Settlement Agreements:

We foster a cooperative environment where both parties can express their interests and work toward an amicable resolution. Our mediation services are designed to empower families to reach agreements tailored to their unique circumstances.

Tailored Financial Solutions for Divorcing Couples: Every financial situation is unique. With expertise in divorce financial analysis, we deliver practical, realistic financial strategies that support both parties as they plan for the future.

Compassionate Support for Divorcing Parties: We prioritize your emotional well-being throughout the process. Our mediation team listens with empathy, ensuring all voices are heard while maintaining a focus on productive, interest-based solutions.

Gold Partner

RE/MAX Results

RE/MAX Results | Shannon Lindstrom

REALTOR® | CDRE®

612-616-9714 | Shannon@ShannonLindstromRealtor.com

ShannonLindstromRealtor.com

Additional Details about RE/MAX Results

Shannon Lindstrom, an experienced REALTOR® with RE/MAX Results, brings a wealth of expertise to the real estate industry. As a Certified Divorce RealEstate Expert (CDRE®) specializing in the Twin Cities, Minnesota region, she holds additional certifications as a Certified Military Residential Specialist (MILRES), Certified Military Veterans Real Estate Agent (VCA), and Military Relocation Professional (MRP). Her professional journey is characterized by a steadfast commitment to staying abreast of market trends, understanding the unique needs of her clients, and consistently delivering exceptional results.

Over the course of her successful career, Ms. Lindstrom has fostered strong connections with her clients, gaining their confidence through an approach characterized by transparency and honesty. Her exceptional negotiation skills have translated into numerous successful transactions and satisfied clients. Ms. Lindstrom possesses a unique position to serve divorcing parties and their attorneys, offering an objective and neutral expert opinion in low and high-conflict divorce matters involving real property. Ms. Lindstrom is well-versed in the intricacies of property transactions, providing comprehensive guidance to both buyers and sellers. Her adept negotiation skills, coupled with a keen awareness of market dynamics, solidify her standing as a trusted advisor within the competitive real estate market.

As an experienced Realtor®, Shannon Lindstrom values collaboration with a diverse range of clients/customers who share a commitment to achieving their unique real estate goals. Her professional approach is tailored to cater to the needs of individuals and families seeking personalized guidance in the dynamic real estate landscape.

AWARDS

RE/MAX Results 2022 – Delta Award Recipient

RE/MAX 2021 & 2022 – 100% Club Award Recipient

Minneapolis Area Association of Realtor® (MAAR) 2019 – Exceptional

Service Award Recipient

RE/MAX 2018 – Executive Club Member Recipient

Shannon Lindstrom, Realtor®, CDRE®, CREDS, CRS, AHWD, GREEN, MILRES, MRP, VCA

RE/MAX Results

7373 Kirkwood Court No, Ste. 300

Maple Grove, MN 55369

Direct: 612-616-9714

Lindstrom_S@msn.com

Shannon@ShannonLindstromRealtor.com

www.ShannonLindstromRealtor.com

www.ShannonLindstrom.info

www.MinnesotaMilitaryVeteranRealEstateAgent.com

www.twincitiesmilitaryveteransrealtor.com

www.MNDivorceRealEstateExpert.com

Silver Partner

Resource Mortgage

Resource Mortgage | Brett Leschinsky

612.590.7896 | brett@mortgageforest.com

mortgageforest.com

Additional Details about Resource Mortgage

Brett has been a respected Mortgage Professional since 2002 and he specializes in home mortgage transactions surrounding a divorce, such as how to remove a name from a current loan and determining if and when you can buy another home.

Brett has been a featured guest on WCCO’s Real Estate Radio Hour to discuss common mistakes divorcing couples make with their home mortgage during the divorce. Also, he has spoken at Family Law Bar Association meetings

Request to receive Brett’s Newsletter: Mortgage Q & A – Helpful Mortgage Information During Divorce. Email: Brett@mortgageforest.com

October 2025 Click Here

July 2025 Click here

June 2025 Click here

May II, 2025 Click here

May 2025 Q&A: Click here

January 2025 Q&A: Click here

November 2024 Q&A: Click here

September 2024 Q&A:

Q: Can Income From A Property Settlement Note Be Used As Qualifying Income For A Mortgage?

A: When there is a business involved in a divorce and one spouse is awarded part of the business’ value but the retaining spouse doesn’t have the equity available to pay them, a Property Settlement Note is sometimes used. This provides a source of monthly income to the spouse not keeping the business.

Fannie and Freddie guidelines DO allow that income to be used as qualifying income for purchasing or refinancing a home, however it must be received on-time and consistently for 12 months or longer AND be expected to continue for 3 years or more according to the note.

Silver Partner

Jennifer Morris - Edina Realty

Edina Realty | Jennifer Morris, Realtor

952-937-8600 | JenniferMorris@EdinaRealty.com

www.edinarealty.com/jennifer-morris-realtor#

Additional Details about Jennifer Morris, Realtor

My team and I provide professional real estate services serving Minneapolis, St. Paul and the metro counties. Contact me for a complimentary market analysis of your home.