After choosing your process wisely, discussed in my two previous blogs part 1 and part II, the next step is to choose your attorney wisely. I believe this is something to approach with significant thought about your goals, careful consideration about the process you want to follow and your own beliefs and values.

How do your goals and process choices affect the choice of an attorney?

When I mention goals, I am not just talking about your goals. The goals of your spouse are just as important. It is important to remember you are not in this divorce alone, your spouse is also present. You both have anxiety, fears, and unanswered questions about how is this all going to turn out. Please do not forget that attorneys selected by each of you will have their own goals. Their goals may not necessarily be in alignment with your own.

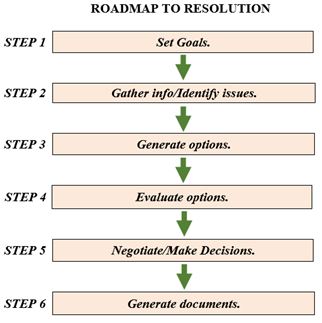

Ideally, you and your spouse are able to discuss your goals together. You both may have some shared goals although in the throes of divorce this may be the furthest thing from both of your minds. Each of you will have some different individual goals. I would suggest to the extent possible working together with your spouse to identify these goals as they relate to children if any, relationship and communication with each other and extended family during and post divorce, financial security goals, and divorce process goals. Your ability to articulate and document these goals will in the end minimize conflict, and give you a roadmap if you will toward selecting attorneys. You will want to choose attorneys who are able to help you and your spouse achieve your goals.

A

collaborative divorce attorney once wrote about asking some straight to the heart kinds of questions when interviewing any divorce attorney. A question like, How concerned are you about what my spouse wants out of this divorce? This is a great question to ask any potential attorney you may be considering. How the attorney answers this question will give you loads of information about how this attorney will go about representing you. If they say I think you should go after all you can get and then promise or insist they can get it for you, they are playing on your emotions and telling you what you want to hear. This attorney is probably more interested in putting on a show that will take money from your family resources instead of allowing you and your spouse to keep more of your money in your family where it belongs.

This same collaborative attorney offered yet another question to ask a potential attorney. Ask if they believe a couple in conflict, going through divorce, can negotiate settlement outcomes without the use of threats or coercion to get what they want. If the attorney insists on using threats and coercion, they are likely not that skilled in interest based negotiations. Instead, they draw lines in the sand using threats and coercion. This leads to even more conflict and increasing costs meaning less money for you and your spouse to keep in your family. A settlement-oriented attorney will answer this question by explaining the differences between position-based negotiation and interest-based negotiation.

One last question to ask a potential attorney is if they handle all parts of the divorce or do they often use outside experts such as a child specialist when children are involved or a financial specialist. The attorney who says they handle everything themselves may end up costing you and your spouse the most. This attorney is saying they are experts with children, finances, and legal matters. Rarely, if ever, is this the case.

A

child specialist financial specialist can bring great value to your divorce process. A parenting plan, which goes far beyond who stays overnight when and a financial plan to give both you and your spouse comfort in knowing you will be making the best use of your financial resources should give you and your spouse a degree of comfort and peace of mind. Besides that the cost of one child specialist and one experienced divorce

financial specialist will be considerably less than attorney costs for dealing with these same issues.

As you listen to the answers potential attorneys give when asked these three questions outlined in this post ask yourself:

Is this attorney able to help me, and my spouse, work through our differences using the process we chose? Will this attorney seek to find outcomes that work not just for me but also for my spouse? Will this attorney choose to do all the work himself or herself or will they utilize experts in specific fields such as children, finances, and or relationship coaches when needed or helpful?

Hearing the answers to these simple questions can help you decide whom to choose as an attorney. Choose wisely by being intentional, thoughtful, and in alignment with your goals, values, and beliefs. Doing so will allow you to keep more of your money in your family.

One of the reasons that divorce is such a challenging life transition is its public nature. A couple might keep their problems private as they try to work through them. But if a rift opens that can’t be mended, the couple will have to share some very difficult news with friends and family as they separate from one another.

Few of us will have to reveal emotional personal issues to as wide an audience as Jeff and MacKenzie Bezos recently did. The statement that Jeff released on Twitter suggests that he and MacKenzie are trying to make their split as amicable as possible by usin three insightful ideas that could help anyone struggling through a divorce.

One of the reasons that divorce is such a challenging life transition is its public nature. A couple might keep their problems private as they try to work through them. But if a rift opens that can’t be mended, the couple will have to share some very difficult news with friends and family as they separate from one another.

Few of us will have to reveal emotional personal issues to as wide an audience as Jeff and MacKenzie Bezos recently did. The statement that Jeff released on Twitter suggests that he and MacKenzie are trying to make their split as amicable as possible by usin three insightful ideas that could help anyone struggling through a divorce.

Do you need a divorce team and if so who should be on that team? If you are going through divorce or plan to do so you should think about who you want to have on your divorce team. Who you have on your team depends on the process you have chosen.

If you are headed down the traditional litigated divorce path your attorney will be your lead team member and possibly could be the only team member. Oh sure you may bring in experts of your own and when you do experts of your soon to be ex will suddenly appear.

This is unlike a

Do you need a divorce team and if so who should be on that team? If you are going through divorce or plan to do so you should think about who you want to have on your divorce team. Who you have on your team depends on the process you have chosen.

If you are headed down the traditional litigated divorce path your attorney will be your lead team member and possibly could be the only team member. Oh sure you may bring in experts of your own and when you do experts of your soon to be ex will suddenly appear.

This is unlike a  When one spouse in a divorce has been unemployed for an extended period, it can often be a frightening situation for that particular spouse. It can also be frightening to the other spouse. This fear shared from opposite perspectives can lead to heightened conflict and tense communications. This conflict and challenged communications can impede the entire divorce process. However, it does not have to be this way.

What if in the divorce process, there was a way for someone to explore these fears from a deeper perspective? The spouse who has been unemployed for some time, perhaps because of child rearing responsibilities, is extremely anxious or downright scared about how they will ever be able to make it. The employed spouse is anxious and downright scared they will forever face having to support their non-working spouse. Both have legitimate fears and concerns. Let us look at some options that may help both at least minimize some of these fears.

In a

When one spouse in a divorce has been unemployed for an extended period, it can often be a frightening situation for that particular spouse. It can also be frightening to the other spouse. This fear shared from opposite perspectives can lead to heightened conflict and tense communications. This conflict and challenged communications can impede the entire divorce process. However, it does not have to be this way.

What if in the divorce process, there was a way for someone to explore these fears from a deeper perspective? The spouse who has been unemployed for some time, perhaps because of child rearing responsibilities, is extremely anxious or downright scared about how they will ever be able to make it. The employed spouse is anxious and downright scared they will forever face having to support their non-working spouse. Both have legitimate fears and concerns. Let us look at some options that may help both at least minimize some of these fears.

In a

The child tax credit may

The child tax credit may