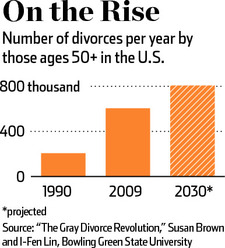

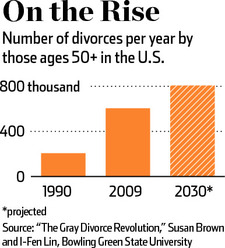

According to a Bowling Green State University study, the divorce rate for those over 50 more than doubled between 1990 and 2009. The trend suggests that by 2030 there will be more than 800,000 divorces per year for the 50 plus age group. This unprecedented rise in gray divorces is occurring while the divorce rate among younger couples is declining.

I will not be a year 2030 statistic. My divorce was final in 2010 after a 32-year marriage, which most definitely puts me in that age 50 plus boomer group. While the Bowling Green study and an endless amount of other research discusses some of the reasons and causes for this divorce demographic, I want to focus on how the issues are different for gray divorces and yet the same as those divorcing at much younger ages.

In my experience, working with spouses as a financial neutral every divorce is unique to each family. However, all divorces have some broad common foundational issues. Every divorce, whether you are in your 50’s and above or younger, has at least some financial issues to be resolved. Divorce financial issues involve allocating assets and liabilities to each spouse in an effort to be fair and equitable. In addition if there are children under the age of 18 providing for the needs of the children is a consideration. In certain situations, spousal maintenance may come into the play.

What is different about financial issues in gray divorces is hypothetically; there are greater assets and fewer liabilities given their longer life and time in the workforce up to this point than their younger counterparts. In my work as a financial neutral with gray divorcees, I can share with you this is not always the case. Many times assets are limited and debts are significant. A collaborative-trained financial neutral is well equipped to help spouses with these and other financial issues.

There is less time for boomer spouses to recover from the financial loss of divorce. Essentially assets and debts are allocated equally with some exceptions that have the effect of reducing the marital estate in half. Sometimes mothers or fathers have stayed at home or otherwise sacrificed to some degree a working career to care for their children. Now in their 50’s and above they will need to do what they can to work towards becoming self-supporting. This is no small order, as we all know how difficult the job market can be for anyone let alone trying to re enter the workforce when you are gray and training and skills may need to be updated.

When there are children under the age of 18 a parenting plan must be established. Parents ideally come to agreements on how to co-parent their minor children. This is not to imply that children older than 18 are not affected by divorce. My children were all adults over the age of 21 when my divorce occurred and I can share the divorce had an impact on their lives as well as mine and my former spouse. While child support financial obligations and parenting time schedules may not be a factor in gray divorces, those adult children need the support of both parents. Gray divorcing clients would do well to consider the support their adult children need. After all, there will still be birthdays, holidays, weddings, graduations, and yes-even grandchildren in the future. Your children regardless of their age want to know they have two loving and caring parents who will always be there for them.

With gray divorces, there are often decade’s long relationships with extended family members. What will these relationships look like in the future? Will the relationships continue to exist or somehow change a result of the divorce? How will what happens to these relationships affect your adult children? All of these and many more questions arise in gray divorces.

Divorce, regardless of age, is never easy nor does it produce any winners in my opinion. However, those who have made the decision to end their marriage would be wise to become knowledgeable of the

collaborative divorce process.

Collaborative Divorce is well suited to handle gray divorces. This process when successfully completed keeps your divorce out of court and thus keeps it private. More importantly, it keeps the outcome in your control. You and your spouse are able to make decisions about your future not a judge with limited information and time. Collaborative divorce is a process that involves dignity, respect, and acknowledges the contributions of each spouse to their marriage.

If you know of anyone who has made the decision to divorce or is seriously considering divorce you would be doing them a favor by letting them know that collaborative divorce is an option and where they can go for more information. To learn more about collaborative divorce visit

www.collaborativelaw.org.

In Part I of Getting Unmarried, Money and Divorce, I talked about the two financial pillars of any divorce. The first being the balance sheet that lists every single asset and liability. The second being forward looking cash flow and support needs for children, if any, and both spouses.

In this post, I will briefly cover some other financial issues common in many divorces. These include some discussion of marital and non-marital property, analyzing tax implications of various scenarios for child support and/or spousal maintenance; analyzing property and business interests, debt pay off scenarios, and comparing pros and cons of using one asset over another.

A financial neutral assists with identifying what is marital and what is non-marital property. Marital property of course is that property acquired during the marriage. Generally, non-marital property is property owned prior to the marriage and brought into the marriage, inherited property, and or property received as a gift. Sometimes this can include a home where the down payment made with non-marital money, a retirement plan when the participant contributed to the plan prior to and during the marriage, or more simply a family heirloom passed down through the generations. Non- marital property generally remains with the receiver of the property and not considered in the allocation of marital property. When there is both marital and non-marital interest in an asset, a financial neutral can help determine the values of both the marital and non-marital interests.

The tax implications for child support and spousal maintenance are different. Child support is not taxable income to the payee and is not deductible by the payer. Spousal maintenance on the other hand is taxable income to the payee and is deductible by the payer in most situations. A qualified financial neutral is able to help a couple determine an optimal combination of child support and spousal maintenance in order to provide the greatest amount of after tax income to the family.

When a couple or one of the spouses owns a business, it is often helpful to determine the business value. If needed a specially trained neutral business valuation expert is engaged to provide this service. These trained experts employ a variety of valuation methodologies to provide an opinion as to the value of a particular business. Depending upon the complexities of the business the time and cost to complete a business valuation can vary.

Debts are another financial area where clients can benefit from the insight of a qualified financial neutral. Facilitating how to allocate debt between two spouses is an important function of the financial neutral. The neutral may suggest the clients consider a number of options available including the potential of reducing or paying off debt with other assets. This can help a couple breathe a little easier when freeing up needed cash flow for living expenses by not continuing to carry current levels of debt.

A well-trained neutral financial specialist helps divorcing clients see the big picture pros and cons of making a number of financial moves during settlement discussions. Clients are then able to make informed educated decisions concerning their financial future. The financial neutral is family centered in the collaborative process and makes every effort to assist divorcing clients reach agreements they both can live with. Only in the collaborative divorce process are clients able to achieve this level of client introspection and decision-making.

Collaborative divorce is not for everyone. Is a collaborative divorce process right for you or someone you know? Click on this link to learn more and decide for yourself. www.collaborativelaw.org

In Part I of Getting Unmarried, Money and Divorce, I talked about the two financial pillars of any divorce. The first being the balance sheet that lists every single asset and liability. The second being forward looking cash flow and support needs for children, if any, and both spouses.

In this post, I will briefly cover some other financial issues common in many divorces. These include some discussion of marital and non-marital property, analyzing tax implications of various scenarios for child support and/or spousal maintenance; analyzing property and business interests, debt pay off scenarios, and comparing pros and cons of using one asset over another.

A financial neutral assists with identifying what is marital and what is non-marital property. Marital property of course is that property acquired during the marriage. Generally, non-marital property is property owned prior to the marriage and brought into the marriage, inherited property, and or property received as a gift. Sometimes this can include a home where the down payment made with non-marital money, a retirement plan when the participant contributed to the plan prior to and during the marriage, or more simply a family heirloom passed down through the generations. Non- marital property generally remains with the receiver of the property and not considered in the allocation of marital property. When there is both marital and non-marital interest in an asset, a financial neutral can help determine the values of both the marital and non-marital interests.

The tax implications for child support and spousal maintenance are different. Child support is not taxable income to the payee and is not deductible by the payer. Spousal maintenance on the other hand is taxable income to the payee and is deductible by the payer in most situations. A qualified financial neutral is able to help a couple determine an optimal combination of child support and spousal maintenance in order to provide the greatest amount of after tax income to the family.

When a couple or one of the spouses owns a business, it is often helpful to determine the business value. If needed a specially trained neutral business valuation expert is engaged to provide this service. These trained experts employ a variety of valuation methodologies to provide an opinion as to the value of a particular business. Depending upon the complexities of the business the time and cost to complete a business valuation can vary.

Debts are another financial area where clients can benefit from the insight of a qualified financial neutral. Facilitating how to allocate debt between two spouses is an important function of the financial neutral. The neutral may suggest the clients consider a number of options available including the potential of reducing or paying off debt with other assets. This can help a couple breathe a little easier when freeing up needed cash flow for living expenses by not continuing to carry current levels of debt.

A well-trained neutral financial specialist helps divorcing clients see the big picture pros and cons of making a number of financial moves during settlement discussions. Clients are then able to make informed educated decisions concerning their financial future. The financial neutral is family centered in the collaborative process and makes every effort to assist divorcing clients reach agreements they both can live with. Only in the collaborative divorce process are clients able to achieve this level of client introspection and decision-making.

Collaborative divorce is not for everyone. Is a collaborative divorce process right for you or someone you know? Click on this link to learn more and decide for yourself. www.collaborativelaw.org  In Part I of Getting Unmarried, Money and Divorce, I talked about the two financial pillars of any divorce. The first being the balance sheet that lists every single asset and liability. The second being forward looking cash flow and support needs for children, if any, and both spouses.

In this post, I will briefly cover some other financial issues common in many divorces. These include some discussion of marital and non-marital property, analyzing tax implications of various scenarios for child support and/or spousal maintenance; analyzing property and business interests, debt pay off scenarios, and comparing pros and cons of using one asset over another.

A financial neutral assists with identifying what is marital and what is non-marital property. Marital property of course is that property acquired during the marriage. Generally, non-marital property is property owned prior to the marriage and brought into the marriage, inherited property, and or property received as a gift. Sometimes this can include a home where the down payment made with non-marital money, a retirement plan when the participant contributed to the plan prior to and during the marriage, or more simply a family heirloom passed down through the generations. Non- marital property generally remains with the receiver of the property and not considered in the allocation of marital property. When there is both marital and non-marital interest in an asset, a financial neutral can help determine the values of both the marital and non-marital interests.

The tax implications for child support and spousal maintenance are different. Child support is not taxable income to the payee and is not deductible by the payer. Spousal maintenance on the other hand is taxable income to the payee and is deductible by the payer in most situations. A qualified financial neutral is able to help a couple determine an optimal combination of child support and spousal maintenance in order to provide the greatest amount of after tax income to the family.

When a couple or one of the spouses owns a business, it is often helpful to determine the business value. If needed a specially trained neutral business valuation expert is engaged to provide this service. These trained experts employ a variety of valuation methodologies to provide an opinion as to the value of a particular business. Depending upon the complexities of the business the time and cost to complete a business valuation can vary.

Debts are another financial area where clients can benefit from the insight of a qualified financial neutral. Facilitating how to allocate debt between two spouses is an important function of the financial neutral. The neutral may suggest the clients consider a number of options available including the potential of reducing or paying off debt with other assets. This can help a couple breathe a little easier when freeing up needed cash flow for living expenses by not continuing to carry current levels of debt.

A well-trained neutral financial specialist helps divorcing clients see the big picture pros and cons of making a number of financial moves during settlement discussions. Clients are then able to make informed educated decisions concerning their financial future. The financial neutral is family centered in the collaborative process and makes every effort to assist divorcing clients reach agreements they both can live with. Only in the collaborative divorce process are clients able to achieve this level of client introspection and decision-making.

Collaborative divorce is not for everyone. Is a collaborative divorce process right for you or someone you know? Click on this link to learn more and decide for yourself. www.collaborativelaw.org

In Part I of Getting Unmarried, Money and Divorce, I talked about the two financial pillars of any divorce. The first being the balance sheet that lists every single asset and liability. The second being forward looking cash flow and support needs for children, if any, and both spouses.

In this post, I will briefly cover some other financial issues common in many divorces. These include some discussion of marital and non-marital property, analyzing tax implications of various scenarios for child support and/or spousal maintenance; analyzing property and business interests, debt pay off scenarios, and comparing pros and cons of using one asset over another.

A financial neutral assists with identifying what is marital and what is non-marital property. Marital property of course is that property acquired during the marriage. Generally, non-marital property is property owned prior to the marriage and brought into the marriage, inherited property, and or property received as a gift. Sometimes this can include a home where the down payment made with non-marital money, a retirement plan when the participant contributed to the plan prior to and during the marriage, or more simply a family heirloom passed down through the generations. Non- marital property generally remains with the receiver of the property and not considered in the allocation of marital property. When there is both marital and non-marital interest in an asset, a financial neutral can help determine the values of both the marital and non-marital interests.

The tax implications for child support and spousal maintenance are different. Child support is not taxable income to the payee and is not deductible by the payer. Spousal maintenance on the other hand is taxable income to the payee and is deductible by the payer in most situations. A qualified financial neutral is able to help a couple determine an optimal combination of child support and spousal maintenance in order to provide the greatest amount of after tax income to the family.

When a couple or one of the spouses owns a business, it is often helpful to determine the business value. If needed a specially trained neutral business valuation expert is engaged to provide this service. These trained experts employ a variety of valuation methodologies to provide an opinion as to the value of a particular business. Depending upon the complexities of the business the time and cost to complete a business valuation can vary.

Debts are another financial area where clients can benefit from the insight of a qualified financial neutral. Facilitating how to allocate debt between two spouses is an important function of the financial neutral. The neutral may suggest the clients consider a number of options available including the potential of reducing or paying off debt with other assets. This can help a couple breathe a little easier when freeing up needed cash flow for living expenses by not continuing to carry current levels of debt.

A well-trained neutral financial specialist helps divorcing clients see the big picture pros and cons of making a number of financial moves during settlement discussions. Clients are then able to make informed educated decisions concerning their financial future. The financial neutral is family centered in the collaborative process and makes every effort to assist divorcing clients reach agreements they both can live with. Only in the collaborative divorce process are clients able to achieve this level of client introspection and decision-making.

Collaborative divorce is not for everyone. Is a collaborative divorce process right for you or someone you know? Click on this link to learn more and decide for yourself. www.collaborativelaw.org