There are few things that distinguish a new phase in life more than changing one’s name. However, one has to do a thorough job of informing the “world” of this change – such as identity providers, business relationships, friends and family.

Identity providers – they make it official.

An obvious place to start, they include the following:

- Driver’s license: go to your local Department of Motor Vehicles office, fill out the appropriate form and submit it with the required documents

- Passport: go to travel.state.gov, fill out Form DS-5504 if your passport is less than one year old or DS-82 if older than one year, and submit it with the required documents

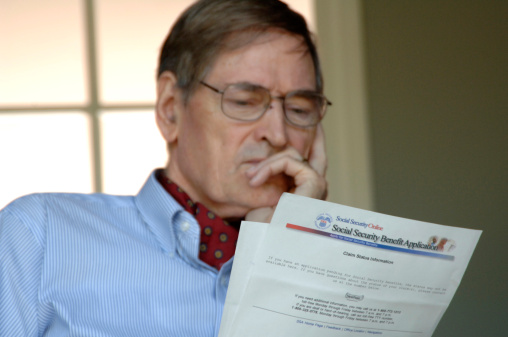

- Social Security Card: go to socialsecurity.gov, fill out form SS-5 and submit it with the required documents

- Voters Registration: re-register at www.sos.state.mn.us

- Veteran’s Affairs: call the DMDC Support Office at 800-538-9552 to update your DEERS information

Certified Divorce Decree

Essential to changing your name on the identity documents listed above, is providing a “certified” divorce decree or other legal name change document. To obtain a certified divorce decree, request one by letter or in person, from the records center at the court where your divorce was filed. You will need:

- Names listed in the decree

- File number

- Courthouse location

- County of the court

- Fee per Copy (typically about $16)

If your divorce was filed in Minnesota, you can find information on where to request a certified divorce decree at

www.mncourts.gov. It is recommended that you order several. Most identity providers will require a certified copy, and often don’t return them. Keep in mind that removing the staple voids your certified copy!

Business Relationships

Business relationships are also essential. Think about every business, medical or financial professional and financial institution with whom you interact and start making a list. Then, add on utilities, shopping websites, magazines and other publications, as well as charitable organizations. The sooner you start, the more likely your lights will stay on, your checks will be honored and your will get the packages you ordered.

IRS

The IRS verifies the names and social security numbers on every tax return with the Social Security database. If you file your tax return before changing your name with the Social Security Administration, use your former name. Any mismatch will result in your return either being rejected immediately or the IRS sending a letter requesting clarification, which will delay any refund you may be due until you reply.

Friends and Family

Your friends and family are the easiest to inform in the internet age; just send out a mass email. Remember to change your social media profiles too. Better yet find a way to celebrate this change! Make an event of it and all your friends and acquaintances are more likely to remember that you have moved on to a new phase in your life.

A large component of a divorce is dividing the assets that you and your spouse accumulated during your marriage. Now that the divorce decree is completed, it is essential to start retitling assets as soon as possible. Retitling of assets confers control by defining ownership and restricting access.

A good way to begin this process is to create a personal net worth statement that lists all of your assets and liabilities, per the divorce decree. This statement will serve as the master checklist in your retitling process. Every asset has its own retitling requirements, but essential to the process are the following documents:

A large component of a divorce is dividing the assets that you and your spouse accumulated during your marriage. Now that the divorce decree is completed, it is essential to start retitling assets as soon as possible. Retitling of assets confers control by defining ownership and restricting access.

A good way to begin this process is to create a personal net worth statement that lists all of your assets and liabilities, per the divorce decree. This statement will serve as the master checklist in your retitling process. Every asset has its own retitling requirements, but essential to the process are the following documents: