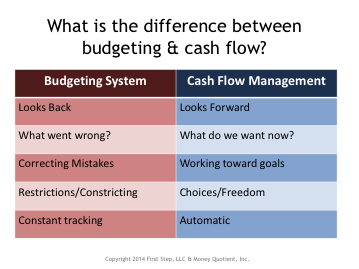

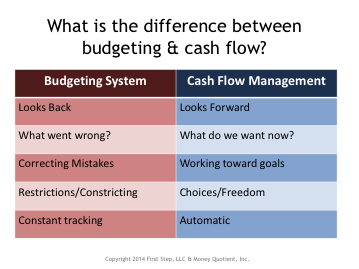

I teach a cash flow planning course throughout the metro area. One of the ways I begin, is by asking everyone to tell me the first word that comes to mind when they hear the word budget? Often it is a negative type of word like restricting, confining, or boring. When I ask a similar question about cash flow, common responses are future and choice. The chart below illustrates some of those differences.

Money is one of those issues often cited as a reason for divorce. I would offer that money itself does not cause divorce. How spouses handle money differently and an inability to recognize their different money personalities and learn effective ways to work through those differences can lead to divorce or at least cause significant strain in a marriage.

Establishing reasonable and necessary future living expenses post-divorce is one of the two pillars of any

divorce process. Both spouses will need to establish their own living expenses independently of one another. If money was a source of conflict in the marriage, imagine the conflict that exists during the divorce process. The reality is the money conflict can and often does escalate in divorce. In my work as a

financial neutral, financial mediator, and financial planner, I work with you and your spouse to help you focus on your future.

One approach to creating a future oriented cash flow plan for your post-divorce life is to add up all of your expenses necessary for your basic living needs. This would include things like housing, food, clothing, and medical care to name a few. If you are familiar with Maslow’s hierarchy of needs, this would be the lower level (safety and security) in the hierarchy. Keep in mind that at this basic level food does not include dining out. Clothing does not include upscale designer clothing. Items in this safety and security level are for basic needs.

After taking care of basic needs you can then address expenses that you have total control and choice over such as dining out, entertainment, cash spending money, gifts, personal care, etc.

Finally, you may want to consider future goals and needs like retirement, creating an emergency savings plan, a different automobile, or an education.

Think of separating these expenses into three different categories. I ask my clients to visualize these as three distinct buckets. The buckets are one for basic needs, two control and choices, and three future needs and wants. It is important to recognize that during and after the divorce, you may need to at least temporarily forgo some if not all of the future needs and wants, and substantially minimize the control and choice buckets due to the initial financial strain of divorce.

It is equally important to recognize this time-period does not necessarily last forever. Incomes can and do increase over time and some expenses such as child-care reduce and ultimately disappear at some point.

A well-developed future oriented cash flow plan can give you the peace of mind to know you will be financially secure. It can give you the opportunity to choose what is important to you about money, prioritize your goals, and create a solid model and roadmap for your life ahead. A financial neutral in

collaborative divorce process will help you create this type of plan.

A short three-minute video on the history of cash flow and money management is available by clicking

here.

Getting unmarried and taxes can become a consideration in terms of whether to have a divorce final by year-end or final after January 1. I have worked on a number of divorce cases where this very topic deserved a thorough analysis to determine which tax filing year to have the divorce final.

Here are a couple of important points to remember. If you are married for the entire year, the choices you have for tax filing are joint or married filing separately. If the courts deem the divorce final no later than December 31, you are considered divorced for the entire year and are not able to file jointly or married filing separately. An entry of divorce on December 31 requires filing as single or if qualified as head of household for the year ended December 31.

How do you determine which year is best? Usually this requires completion of the various tax return scenarios by a qualified tax advisor normally a CPA or Enrolled Agent. They will run the numbers for a joint return as if the couple was married the entire year. Next, they will run the numbers as if they were divorced for the year with either a single or Head of Household filing status if qualified. Whatever method results in the lowest combined tax for the couple preserves more of the family assets and resources. Sometimes this can amount to thousands of dollars.

I recently concluded a collaborative divorce case as a financial neutral for a couple where this very issue came up. My initial analysis revealed the couple could in-fact save thousands of dollars by having the divorce final by year-end vs. filing a joint return for 2014 and the divorce final in 2015. A thorough and complete analysis by a CPA confirmed the couple would save approximately $20,000 in income taxes by having the divorce final no later than December 31.

Needless to say, this couple would much rather have the $20,000 in their pockets vs. having to forfeit that amount to the I.R.S. Although divorce documents are e-filed with the courts, there is no guarantee the divorce will be final by December 31. Once the documents are received by the courts, the file is assigned to a judicial officer for review. Files submitted in late November and December are not automatically reviewed and approved by year-end. Attorneys working on the case will often make requests to have the review and entry of divorce completed by December 31. I hope that in this most recent case it will be. It is always worth a try especially when you have $20,000 on the table.

Do not overlook the tax strategies and any potential savings when divorcing near year-end. It could potentially save you and your family a bundle.

Getting unmarried and taxes can become a consideration in terms of whether to have a divorce final by year-end or final after January 1. I have worked on a number of divorce cases where this very topic deserved a thorough analysis to determine which tax filing year to have the divorce final.

Here are a couple of important points to remember. If you are married for the entire year, the choices you have for tax filing are joint or married filing separately. If the courts deem the divorce final no later than December 31, you are considered divorced for the entire year and are not able to file jointly or married filing separately. An entry of divorce on December 31 requires filing as single or if qualified as head of household for the year ended December 31.

How do you determine which year is best? Usually this requires completion of the various tax return scenarios by a qualified tax advisor normally a CPA or Enrolled Agent. They will run the numbers for a joint return as if the couple was married the entire year. Next, they will run the numbers as if they were divorced for the year with either a single or Head of Household filing status if qualified. Whatever method results in the lowest combined tax for the couple preserves more of the family assets and resources. Sometimes this can amount to thousands of dollars.

I recently concluded a collaborative divorce case as a financial neutral for a couple where this very issue came up. My initial analysis revealed the couple could in-fact save thousands of dollars by having the divorce final by year-end vs. filing a joint return for 2014 and the divorce final in 2015. A thorough and complete analysis by a CPA confirmed the couple would save approximately $20,000 in income taxes by having the divorce final no later than December 31.

Needless to say, this couple would much rather have the $20,000 in their pockets vs. having to forfeit that amount to the I.R.S. Although divorce documents are e-filed with the courts, there is no guarantee the divorce will be final by December 31. Once the documents are received by the courts, the file is assigned to a judicial officer for review. Files submitted in late November and December are not automatically reviewed and approved by year-end. Attorneys working on the case will often make requests to have the review and entry of divorce completed by December 31. I hope that in this most recent case it will be. It is always worth a try especially when you have $20,000 on the table.

Do not overlook the tax strategies and any potential savings when divorcing near year-end. It could potentially save you and your family a bundle.  Getting unmarried and taxes can become a consideration in terms of whether to have a divorce final by year-end or final after January 1. I have worked on a number of divorce cases where this very topic deserved a thorough analysis to determine which tax filing year to have the divorce final.

Here are a couple of important points to remember. If you are married for the entire year, the choices you have for tax filing are joint or married filing separately. If the courts deem the divorce final no later than December 31, you are considered divorced for the entire year and are not able to file jointly or married filing separately. An entry of divorce on December 31 requires filing as single or if qualified as head of household for the year ended December 31.

How do you determine which year is best? Usually this requires completion of the various tax return scenarios by a qualified tax advisor normally a CPA or Enrolled Agent. They will run the numbers for a joint return as if the couple was married the entire year. Next, they will run the numbers as if they were divorced for the year with either a single or Head of Household filing status if qualified. Whatever method results in the lowest combined tax for the couple preserves more of the family assets and resources. Sometimes this can amount to thousands of dollars.

I recently concluded a collaborative divorce case as a financial neutral for a couple where this very issue came up. My initial analysis revealed the couple could in-fact save thousands of dollars by having the divorce final by year-end vs. filing a joint return for 2014 and the divorce final in 2015. A thorough and complete analysis by a CPA confirmed the couple would save approximately $20,000 in income taxes by having the divorce final no later than December 31.

Needless to say, this couple would much rather have the $20,000 in their pockets vs. having to forfeit that amount to the I.R.S. Although divorce documents are e-filed with the courts, there is no guarantee the divorce will be final by December 31. Once the documents are received by the courts, the file is assigned to a judicial officer for review. Files submitted in late November and December are not automatically reviewed and approved by year-end. Attorneys working on the case will often make requests to have the review and entry of divorce completed by December 31. I hope that in this most recent case it will be. It is always worth a try especially when you have $20,000 on the table.

Do not overlook the tax strategies and any potential savings when divorcing near year-end. It could potentially save you and your family a bundle.

Getting unmarried and taxes can become a consideration in terms of whether to have a divorce final by year-end or final after January 1. I have worked on a number of divorce cases where this very topic deserved a thorough analysis to determine which tax filing year to have the divorce final.

Here are a couple of important points to remember. If you are married for the entire year, the choices you have for tax filing are joint or married filing separately. If the courts deem the divorce final no later than December 31, you are considered divorced for the entire year and are not able to file jointly or married filing separately. An entry of divorce on December 31 requires filing as single or if qualified as head of household for the year ended December 31.

How do you determine which year is best? Usually this requires completion of the various tax return scenarios by a qualified tax advisor normally a CPA or Enrolled Agent. They will run the numbers for a joint return as if the couple was married the entire year. Next, they will run the numbers as if they were divorced for the year with either a single or Head of Household filing status if qualified. Whatever method results in the lowest combined tax for the couple preserves more of the family assets and resources. Sometimes this can amount to thousands of dollars.

I recently concluded a collaborative divorce case as a financial neutral for a couple where this very issue came up. My initial analysis revealed the couple could in-fact save thousands of dollars by having the divorce final by year-end vs. filing a joint return for 2014 and the divorce final in 2015. A thorough and complete analysis by a CPA confirmed the couple would save approximately $20,000 in income taxes by having the divorce final no later than December 31.

Needless to say, this couple would much rather have the $20,000 in their pockets vs. having to forfeit that amount to the I.R.S. Although divorce documents are e-filed with the courts, there is no guarantee the divorce will be final by December 31. Once the documents are received by the courts, the file is assigned to a judicial officer for review. Files submitted in late November and December are not automatically reviewed and approved by year-end. Attorneys working on the case will often make requests to have the review and entry of divorce completed by December 31. I hope that in this most recent case it will be. It is always worth a try especially when you have $20,000 on the table.

Do not overlook the tax strategies and any potential savings when divorcing near year-end. It could potentially save you and your family a bundle.