My kids are spirited. Not possessed, although somedays it seems like they are. I thought the term “spirited child” referred to a child with ADD or ADHD. Not true. It’s not a diagnosis – it’s simply temperament. Thank goodness for Minnesota’s own Mary Sheedy Kurcinka and her book, “Raising Your Spirited Child.” As soon as I finished it, I started reading it again.

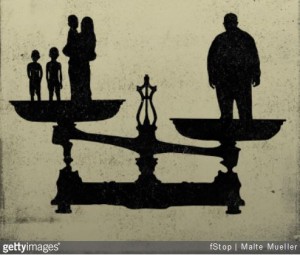

Spirited kids are just “more,” and my two kiddos are high energy, intense, persistent, and slow to adapt. This slow-to-adapt trait makes transitions a CONSTANT battle. It’s hard enough getting my two out the door to school every day. Then I think about kids whose parents are going through a divorce. Not only are kids of divorce doing the everyday school, activities, home, etc., but they have

two homes to toggle between. I’m sure it’s hard for any kid to go back and forth between two homes. Most adapt, though. But if you have a child who doesn’t like transitions, and mix in some frustration and sadness of the divorce, you have the ingredients for a frustrating, heart-breaking battle between parent and child. What to do?

Regardless of whether they are spirited, but especially if they are, listen to your children. Understand what your children are going through. It’s never too late to get a child specialist involved in the process, even post-decree. Talk

with your children them, instead of

at them. They didn’t ask to be in this position and they have NO control over the divorce. Help them feel like they have some control over their world. Don’t just assume they are doing well because they are getting straight A’s, or they’ll be OK when the divorce is final. Maybe they will be OK. After all, kids are resilient. But they’re your kids. And I think it’s our duty as parents to do as much for our kids emotionally as we can. They deserve it.

Divorce has a way of completely upsetting one’s expectations for the future. One day things are moving along just fine, and the next you are making decisions that will impact the rest of your life. One of the big decisions is whether or not to keep the family home. It may really be two questions: “Should I keep the house?” and “Can I keep the house?”. Let’s consider both in turn.

Whether you “should” keep the home is more of an emotional question. What does the home represent to you? Often it is an emotional safe haven full of good memories that you have spent years getting just right. It could also be an emotional roadblock to moving forward with your life.

“Can I keep the house?” is more of a financial question. Will your income post-divorce allow you to maintain the house? Will taking the house in the divorce mean forgoing other marital assets such as retirement accounts, that may be more valuable in the long run? Perhaps keeping the house will require keeping your ex-spouse as co-owner, do you want that?

Due to its functionality, your house is an asset different from a stock or retirement account. So, in many cases, the decision is a compromise focused on the question: “How long should I stay in the house?”.

If you are unsure of the best way to handle the house, there are 3 exercises that you should go through to determine your best decision or when you should expect to sell.

Divorce has a way of completely upsetting one’s expectations for the future. One day things are moving along just fine, and the next you are making decisions that will impact the rest of your life. One of the big decisions is whether or not to keep the family home. It may really be two questions: “Should I keep the house?” and “Can I keep the house?”. Let’s consider both in turn.

Whether you “should” keep the home is more of an emotional question. What does the home represent to you? Often it is an emotional safe haven full of good memories that you have spent years getting just right. It could also be an emotional roadblock to moving forward with your life.

“Can I keep the house?” is more of a financial question. Will your income post-divorce allow you to maintain the house? Will taking the house in the divorce mean forgoing other marital assets such as retirement accounts, that may be more valuable in the long run? Perhaps keeping the house will require keeping your ex-spouse as co-owner, do you want that?

Due to its functionality, your house is an asset different from a stock or retirement account. So, in many cases, the decision is a compromise focused on the question: “How long should I stay in the house?”.

If you are unsure of the best way to handle the house, there are 3 exercises that you should go through to determine your best decision or when you should expect to sell.