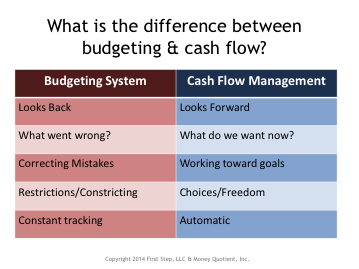

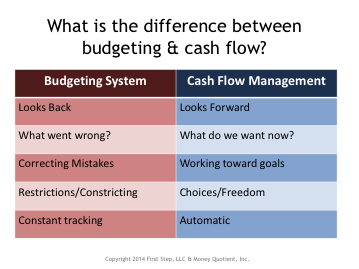

I teach a cash flow planning course throughout the metro area. One of the ways I begin, is by asking everyone to tell me the first word that comes to mind when they hear the word budget? Often it is a negative type of word like restricting, confining, or boring. When I ask a similar question about cash flow, common responses are future and choice. The chart below illustrates some of those differences.

Money is one of those issues often cited as a reason for divorce. I would offer that money itself does not cause divorce. How spouses handle money differently and an inability to recognize their different money personalities and learn effective ways to work through those differences can lead to divorce or at least cause significant strain in a marriage.

Establishing reasonable and necessary future living expenses post-divorce is one of the two pillars of any

divorce process. Both spouses will need to establish their own living expenses independently of one another. If money was a source of conflict in the marriage, imagine the conflict that exists during the divorce process. The reality is the money conflict can and often does escalate in divorce. In my work as a

financial neutral, financial mediator, and financial planner, I work with you and your spouse to help you focus on your future.

One approach to creating a future oriented cash flow plan for your post-divorce life is to add up all of your expenses necessary for your basic living needs. This would include things like housing, food, clothing, and medical care to name a few. If you are familiar with Maslow’s hierarchy of needs, this would be the lower level (safety and security) in the hierarchy. Keep in mind that at this basic level food does not include dining out. Clothing does not include upscale designer clothing. Items in this safety and security level are for basic needs.

After taking care of basic needs you can then address expenses that you have total control and choice over such as dining out, entertainment, cash spending money, gifts, personal care, etc.

Finally, you may want to consider future goals and needs like retirement, creating an emergency savings plan, a different automobile, or an education.

Think of separating these expenses into three different categories. I ask my clients to visualize these as three distinct buckets. The buckets are one for basic needs, two control and choices, and three future needs and wants. It is important to recognize that during and after the divorce, you may need to at least temporarily forgo some if not all of the future needs and wants, and substantially minimize the control and choice buckets due to the initial financial strain of divorce.

It is equally important to recognize this time-period does not necessarily last forever. Incomes can and do increase over time and some expenses such as child-care reduce and ultimately disappear at some point.

A well-developed future oriented cash flow plan can give you the peace of mind to know you will be financially secure. It can give you the opportunity to choose what is important to you about money, prioritize your goals, and create a solid model and roadmap for your life ahead. A financial neutral in

collaborative divorce process will help you create this type of plan.

A short three-minute video on the history of cash flow and money management is available by clicking

here.

I’m not always a very wise shopper. I tend to fall into the trap of thinking something is a good deal if I save money. And at least in the short term, my cheaper purchase may do just fine.

But inevitably, cheap purchases lack staying power and don’t hold up well. I was reminded of this recently when looking in dismay at the boots I bought on sale at a discount shoe store. After one season of wear, the leather has frayed on the toes of both boots, and they won’t be wearable next season. In contrast, the Frye boots I splurged on when I was accepted into graduate school decades ago still look great. I knew at the time that these boots were an investment meant to last.

When some potential clients hear about Collaborative Team Practice, their first response is, “That sounds too expensive. I don’t want to spend much money on a divorce.” Because most people have to budget money with some care, it can easily feel like professional fees are not where limited resources should go. But be aware of the trap of thinking something is a good deal if it saves money.

A quality divorce process is an investment in the future, especially when children are involved. Collaborative professionals are experts in conflict resolution and creative problem solving, and can respectfully support families through the crisis of divorce to sustainable resolutions. Collaborative professionals are deeply knowledgeable in their areas of expertise—family law, financial resolutions, children’s needs in divorce, parenting plans and co-parenting skills. Simply put, the right Collaborative professional will help you understand what you may well not know about how to make the best possible decisions on behalf of yourself and your family.

The least expensive divorce options may seem adequate at the time, but the results are often not sustainable. This may mean heading back into a post-decree legal process that is guaranteed to be costly. Collaborative Team Practice is not the best fit for all divorces, but when it is, it is clearly an investment in quality outcomes with staying power for the future. For more information, check out the Collaborative Law Institute website.

I’m not always a very wise shopper. I tend to fall into the trap of thinking something is a good deal if I save money. And at least in the short term, my cheaper purchase may do just fine.

But inevitably, cheap purchases lack staying power and don’t hold up well. I was reminded of this recently when looking in dismay at the boots I bought on sale at a discount shoe store. After one season of wear, the leather has frayed on the toes of both boots, and they won’t be wearable next season. In contrast, the Frye boots I splurged on when I was accepted into graduate school decades ago still look great. I knew at the time that these boots were an investment meant to last.

When some potential clients hear about Collaborative Team Practice, their first response is, “That sounds too expensive. I don’t want to spend much money on a divorce.” Because most people have to budget money with some care, it can easily feel like professional fees are not where limited resources should go. But be aware of the trap of thinking something is a good deal if it saves money.

A quality divorce process is an investment in the future, especially when children are involved. Collaborative professionals are experts in conflict resolution and creative problem solving, and can respectfully support families through the crisis of divorce to sustainable resolutions. Collaborative professionals are deeply knowledgeable in their areas of expertise—family law, financial resolutions, children’s needs in divorce, parenting plans and co-parenting skills. Simply put, the right Collaborative professional will help you understand what you may well not know about how to make the best possible decisions on behalf of yourself and your family.

The least expensive divorce options may seem adequate at the time, but the results are often not sustainable. This may mean heading back into a post-decree legal process that is guaranteed to be costly. Collaborative Team Practice is not the best fit for all divorces, but when it is, it is clearly an investment in quality outcomes with staying power for the future. For more information, check out the Collaborative Law Institute website.  I’m not always a very wise shopper. I tend to fall into the trap of thinking something is a good deal if I save money. And at least in the short term, my cheaper purchase may do just fine.

But inevitably, cheap purchases lack staying power and don’t hold up well. I was reminded of this recently when looking in dismay at the boots I bought on sale at a discount shoe store. After one season of wear, the leather has frayed on the toes of both boots, and they won’t be wearable next season. In contrast, the Frye boots I splurged on when I was accepted into graduate school decades ago still look great. I knew at the time that these boots were an investment meant to last.

When some potential clients hear about Collaborative Team Practice, their first response is, “That sounds too expensive. I don’t want to spend much money on a divorce.” Because most people have to budget money with some care, it can easily feel like professional fees are not where limited resources should go. But be aware of the trap of thinking something is a good deal if it saves money.

A quality divorce process is an investment in the future, especially when children are involved. Collaborative professionals are experts in conflict resolution and creative problem solving, and can respectfully support families through the crisis of divorce to sustainable resolutions. Collaborative professionals are deeply knowledgeable in their areas of expertise—family law, financial resolutions, children’s needs in divorce, parenting plans and co-parenting skills. Simply put, the right Collaborative professional will help you understand what you may well not know about how to make the best possible decisions on behalf of yourself and your family.

The least expensive divorce options may seem adequate at the time, but the results are often not sustainable. This may mean heading back into a post-decree legal process that is guaranteed to be costly. Collaborative Team Practice is not the best fit for all divorces, but when it is, it is clearly an investment in quality outcomes with staying power for the future. For more information, check out the Collaborative Law Institute website.

I’m not always a very wise shopper. I tend to fall into the trap of thinking something is a good deal if I save money. And at least in the short term, my cheaper purchase may do just fine.

But inevitably, cheap purchases lack staying power and don’t hold up well. I was reminded of this recently when looking in dismay at the boots I bought on sale at a discount shoe store. After one season of wear, the leather has frayed on the toes of both boots, and they won’t be wearable next season. In contrast, the Frye boots I splurged on when I was accepted into graduate school decades ago still look great. I knew at the time that these boots were an investment meant to last.

When some potential clients hear about Collaborative Team Practice, their first response is, “That sounds too expensive. I don’t want to spend much money on a divorce.” Because most people have to budget money with some care, it can easily feel like professional fees are not where limited resources should go. But be aware of the trap of thinking something is a good deal if it saves money.

A quality divorce process is an investment in the future, especially when children are involved. Collaborative professionals are experts in conflict resolution and creative problem solving, and can respectfully support families through the crisis of divorce to sustainable resolutions. Collaborative professionals are deeply knowledgeable in their areas of expertise—family law, financial resolutions, children’s needs in divorce, parenting plans and co-parenting skills. Simply put, the right Collaborative professional will help you understand what you may well not know about how to make the best possible decisions on behalf of yourself and your family.

The least expensive divorce options may seem adequate at the time, but the results are often not sustainable. This may mean heading back into a post-decree legal process that is guaranteed to be costly. Collaborative Team Practice is not the best fit for all divorces, but when it is, it is clearly an investment in quality outcomes with staying power for the future. For more information, check out the Collaborative Law Institute website.