In part I of keep more of your money in your family; choosing your process wisely I wrote about the well known traditional litigated court based divorce process and mediation. In this issue, I will cover Collaborative Divorce.

Collaborative divorce is an option you and your spouse should thoroughly explore before making any choice about divorce process. It is my belief that you and your spouse should first decide upon process before you ever hire an attorney. You can then match the right attorney to the right process. Just because they are, a divorce attorney does not mean they can be effective and efficient in all processes. In a collaborative divorce , a collaboratively trained attorney through the entire process represents each spouse.

A financial specialist helps couples sort out their financial issues including gathering all the financial data necessary for the divorce decree and presenting it to their respective attorneys in a format that helps attorneys review the numbers more efficiently. Contrast this with you and your spouse providing each of your attorneys the financial data, the two attorneys talking together about the financial data and then going back to you their client to discuss those conversations then going back again to the other attorney to discuss. Let me ask you on just this one basic step in the financial process, do you think you would keep more of your money in your family? Do you want to be paying two attorneys to do this financial data gathering or would you prefer to pay one financial specialist? A financial specialist is the one person who is in the best position to help you keep more of your financial resources in your family throughout the divorce process. They can save you taxes, come up with some creative options, and other ideas that allow both you and your spouse to create the best financial outcome for each of you given your existing resources.

In any divorce with minor children, a parenting plan is created and documented. In the collaborative divorce process, this is usually completed with a child specialist. This person helps parents articulate and document a well thought out plan to co-parent their children. The child specialist meets with the parents and often times meets with the children separately and then with everyone together. This level of attention to the family well-being is not found in other processes. You can of course work with two attorneys or a mediator to come up with a parenting time schedule and perhaps another piece or two of a well thought out plan. What you are not likely to get is a complete parenting plan that increases the likelihood of your children successfully navigating your divorce with you and your spouse.

Also available in the collaborative divorce process is a neutral divorce coach. The divorce coach helps spouses communicate effectively during the divorce process and come up with a plan for post divorce communication and relationship. This can lower conflict, which can decrease costs. If emotions run high at some point during the divorce process, a coach acts to ground you in the areas that are important to you. This enables both you and your spouse, to effectively communicate your needs, interests, and concerns all necessary to produce the higher-level outcome intended to last for a long time.

It is interesting to me that I often hear people say they are concerned about divorce costs when learning about collaborative divorce. Yet the collaborative divorce process minimizes attorney involvement since much of the work with the neutral financial specialist, neutral child specialist, and neutral divorce coach is completed without attorneys present. Attorneys usually are the highest paid professionals in any divorce process and most are not trained in financial issues, child and family systems, or other family relationship dynamics. What attorneys are trained in is the law. So imagine yourself utilizing a divorce process providing you with a menu of professional resources to help you and your family work with specialists in their respective fields and yet always have access to your own attorney who will be your advocate. Of the three processes discussed in this two issue article which do you think will allow you to keep more of your money in your family, traditional litigation, mediation, or collaborative divorce?

Remember to help you keep more of your money in your family choose your process wisely. In Part II of Keep More of Your Money in Your Family, I will write about choosing your attorney wisely.

Getting married sometimes can be expensive if you let it. Getting unmarried can be even more expensive if you and or your spouse allows it to get that way. In divorce, emotions are high and often contribute to higher levels of conflict. Conflict is expensive. Many divorcing couples want to know how they can keep more of their financial resources between themselves and in their family. After all the more that goes to pay for divorce costs means less for each spouse and for their children if they have children. In this upcoming series, I will write about some tips on how to keep more of your financial resources in your family. Here is the first tip:

Getting married sometimes can be expensive if you let it. Getting unmarried can be even more expensive if you and or your spouse allows it to get that way. In divorce, emotions are high and often contribute to higher levels of conflict. Conflict is expensive. Many divorcing couples want to know how they can keep more of their financial resources between themselves and in their family. After all the more that goes to pay for divorce costs means less for each spouse and for their children if they have children. In this upcoming series, I will write about some tips on how to keep more of your financial resources in your family. Here is the first tip:

- Choose your process wisely. Study your options and know what you and your spouse want. I ask divorcing clients what would need to happen in your divorce so you could look back three years from now and say this was a successful transition for your family and you. Paint that picture for me. Be honest with yourself.

- If you want a knock down drag out divorce, you know the Katie bar the door kind or I will show him/her, or I will make him/her pay, a more traditional litigation process certainly fits that bill. Moreover, that bill will be very expensive. On top of that, someone else, a judge, will be making decisions for you since you and your spouse are not able to reach agreements on your own. If you think, you are going to win and be the victor you have already lost because there are no winners in divorce. Most judges tend to think the best outcome if they have to decide your divorce is one when both spouses equally share the pain and both spouses are somewhat dissatisfied.

- You may consider mediation. Most people have heard about mediation. Mediation can be less expensive than a traditional court based process. Mediators however, are not able to provide legal advice. This is true even if the mediator is an attorney. Sometimes couples choose to have their own lawyers present at mediation sessions to overcome the no legal advice dilemma. Mediators, even if they are an attorney are not able to draft/prepare final divorce decree documents. If a mediator helps you reach agreements, you, and your spouse take those agreements to an attorney to draft the final documents and that attorney can only represent one of you, not both spouses. I always encourage my divorcing clients to each have their own attorney when reviewing any final documents resulting from mediation. You may run into one or both of the attorneys encouraging you not to accept the mediated agreements or parts of the agreements. In my practice, I recommend to clients attorneys that I know and have worked with, are settlement oriented, and not inclined to escalate conflict in an already mediated agreement. That is not to say there will not be some tweaks here and there because there always are and for good reason.

In my financial planning practice and working as a financial neutral helping divorcing couples sort out financial issues it is often challenging for clients to clearly articulate future goals. I am not talking about the kinds of goals such as I want the house or this or that possession. Those types of statements really are what we call positions.

I am talking about big picture interest based goals for your future. You might ask why this is important. I just want to be done with this divorce so I can move on. The problem is being done does not necessarily mean you will be better prepared to move on. More than likely if your focus is to be done, moving on will probably be very challenging for you. Establishing your goals at the very beginning of a collaborative divorce is critically important because goals establish a foundation for future discussions, negotiations, and more importantly stronger communication channels with your soon to be ex-spouse. Goals may be about any particular topic. Usually they fall into the three broad categories of parenting, financial, and relationships.

Let us say for instance it is important for you to remain in the same school district so your children are not uprooted to new schools at the same time you and your spouse will soon be living in separate residences. Moving to a new school district while moving to two separate households may create significant insecurity for your children. This goal example states what the goal is: keep the kids in the same school district, and the why: to minimize the insecurity to your children. From this one goal, we can then figure out the who, when, and how. This single goal may produce discussions about housing, transportation, children’s activities, financial decisions, and overnights with one parent or the other that can lead both spouses to be stronger co-parents for the benefit of their children.

Another goal example in the area of financial matters may be; we want financial viability for both households so we can have a sense of financial security. Note this is not a statement about who gets what but rather a statement about how you want to feel. No one ever tells me his or her goal is financial insecurity.

An example of a relationship goal may be; we want to continue extended family relationships and participate together in family events as possible and to recognize these relationships do not necessarily end just because our marriage is ending. Another relationship goal would be to describe how you want your relationship to be with your spouse post divorce.

Establishing clear big picture goals early on in the divorce process can help to keep you and other professionals on track. Goals give you and your spouse anchor points for the discussions and decisions that will need to be made concerning your futures. We all remember the old saying if you do not know where you are going any road will get you there. Divorcing couples will be wise to discuss together where they want to go by setting clear individual and joint needs and interest goals. Know where you are going. The Collaborative divorce process gives you this opportunity. Choose your process wisely.

In my financial planning practice and working as a financial neutral helping divorcing couples sort out financial issues it is often challenging for clients to clearly articulate future goals. I am not talking about the kinds of goals such as I want the house or this or that possession. Those types of statements really are what we call positions.

I am talking about big picture interest based goals for your future. You might ask why this is important. I just want to be done with this divorce so I can move on. The problem is being done does not necessarily mean you will be better prepared to move on. More than likely if your focus is to be done, moving on will probably be very challenging for you. Establishing your goals at the very beginning of a collaborative divorce is critically important because goals establish a foundation for future discussions, negotiations, and more importantly stronger communication channels with your soon to be ex-spouse. Goals may be about any particular topic. Usually they fall into the three broad categories of parenting, financial, and relationships.

Let us say for instance it is important for you to remain in the same school district so your children are not uprooted to new schools at the same time you and your spouse will soon be living in separate residences. Moving to a new school district while moving to two separate households may create significant insecurity for your children. This goal example states what the goal is: keep the kids in the same school district, and the why: to minimize the insecurity to your children. From this one goal, we can then figure out the who, when, and how. This single goal may produce discussions about housing, transportation, children’s activities, financial decisions, and overnights with one parent or the other that can lead both spouses to be stronger co-parents for the benefit of their children.

Another goal example in the area of financial matters may be; we want financial viability for both households so we can have a sense of financial security. Note this is not a statement about who gets what but rather a statement about how you want to feel. No one ever tells me his or her goal is financial insecurity.

An example of a relationship goal may be; we want to continue extended family relationships and participate together in family events as possible and to recognize these relationships do not necessarily end just because our marriage is ending. Another relationship goal would be to describe how you want your relationship to be with your spouse post divorce.

Establishing clear big picture goals early on in the divorce process can help to keep you and other professionals on track. Goals give you and your spouse anchor points for the discussions and decisions that will need to be made concerning your futures. We all remember the old saying if you do not know where you are going any road will get you there. Divorcing couples will be wise to discuss together where they want to go by setting clear individual and joint needs and interest goals. Know where you are going. The Collaborative divorce process gives you this opportunity. Choose your process wisely.  What can an orange possibly help us with in our collaborative divorce or any divorce process for that matter? You may have heard about interest based negotiations vs. position based negotiations. When I am working as a financial neutral or mediator with divorcing couples, I use an orange to demonstrate these two different approaches.

I place an orange on the table and then say to the couple; here we have one orange for the two of you. How are you going to decide who gets the orange? Most people will say cut it in half. While this certainly works, it may not be the best approach. Here is why.

I then tell them each why they want the orange. One wants it to eat because they are hungry. The other wants the orange peel for baking. Now if we were to cut it in half as most people will say they both only get half of what they need. It is only when they state why the orange is important to them that an agreement can be reached.

When negotiating divorce issues think of the orange and remember to talk about your interests instead of locking into a position. The quicker you get to the interests you will be that much closer to an agreement. Not only is emotion and conflict minimized you also get more of what you need/want. Think orange.

What can an orange possibly help us with in our collaborative divorce or any divorce process for that matter? You may have heard about interest based negotiations vs. position based negotiations. When I am working as a financial neutral or mediator with divorcing couples, I use an orange to demonstrate these two different approaches.

I place an orange on the table and then say to the couple; here we have one orange for the two of you. How are you going to decide who gets the orange? Most people will say cut it in half. While this certainly works, it may not be the best approach. Here is why.

I then tell them each why they want the orange. One wants it to eat because they are hungry. The other wants the orange peel for baking. Now if we were to cut it in half as most people will say they both only get half of what they need. It is only when they state why the orange is important to them that an agreement can be reached.

When negotiating divorce issues think of the orange and remember to talk about your interests instead of locking into a position. The quicker you get to the interests you will be that much closer to an agreement. Not only is emotion and conflict minimized you also get more of what you need/want. Think orange.  A strategy used by some divorcing spouses and their attorneys is to threaten that they will take the other spouse to court. Threatening court is a negotiation strategy in an effort to get the other side to give up or significantly compromise their position(s).

When attorneys use this tactic, they often will prepare for a trial. The trial preparation ends up being extremely expensive and emotionally exhausting for the involved spouses. Often a hatred for the other spouse develops because of trials and/or the threatened use of court.

The reality is a small fraction of divorces end up in trial. The overwhelming reason those cases do end up in trial is because spouses and their attorneys refuse to negotiate. Sometimes a spouse will tell their attorney to go for the throat or they say I want to make him/her pay. It is the divorcing spouses and unfortunately their children, if any, that end up paying the price financially and emotionally. Seeking revenge does not have a place in any divorce process and accompanied by an unwillingness to negotiate in good faith sets up a strategy to fail.

Collaborative divorce on the other hand takes the threatened use of court totally out of the picture. Both spouses are represented by their own collaboratively trained attorney. Spouses and attorneys alike commit in writing not to go to court. Conceptually this enhances the likelihood of reaching agreements by placing the spouses and their attorneys on the same side of the table in an effort to settle on all issues.

Let me ask you which process do you think provides both spouses with a potentially better outcome? Which process do you think you will have the most control over the outcome? Which process will give your children, if any, a better opportunity for future success by creating an effective co-parenting plan? Finally, which process will seek to minimize the stress both emotionally and financially for you and your spouse?

Download this free divorce knowledge kit showing a comparison chart between collaborative divorce and a court-based litigation process, case studies, and general information how a collaborative divorce may benefit you. Additional divorce resources can be found under the about us section at www.integrashieldfinancial.com. Remember to choose your process wisely.

A strategy used by some divorcing spouses and their attorneys is to threaten that they will take the other spouse to court. Threatening court is a negotiation strategy in an effort to get the other side to give up or significantly compromise their position(s).

When attorneys use this tactic, they often will prepare for a trial. The trial preparation ends up being extremely expensive and emotionally exhausting for the involved spouses. Often a hatred for the other spouse develops because of trials and/or the threatened use of court.

The reality is a small fraction of divorces end up in trial. The overwhelming reason those cases do end up in trial is because spouses and their attorneys refuse to negotiate. Sometimes a spouse will tell their attorney to go for the throat or they say I want to make him/her pay. It is the divorcing spouses and unfortunately their children, if any, that end up paying the price financially and emotionally. Seeking revenge does not have a place in any divorce process and accompanied by an unwillingness to negotiate in good faith sets up a strategy to fail.

Collaborative divorce on the other hand takes the threatened use of court totally out of the picture. Both spouses are represented by their own collaboratively trained attorney. Spouses and attorneys alike commit in writing not to go to court. Conceptually this enhances the likelihood of reaching agreements by placing the spouses and their attorneys on the same side of the table in an effort to settle on all issues.

Let me ask you which process do you think provides both spouses with a potentially better outcome? Which process do you think you will have the most control over the outcome? Which process will give your children, if any, a better opportunity for future success by creating an effective co-parenting plan? Finally, which process will seek to minimize the stress both emotionally and financially for you and your spouse?

Download this free divorce knowledge kit showing a comparison chart between collaborative divorce and a court-based litigation process, case studies, and general information how a collaborative divorce may benefit you. Additional divorce resources can be found under the about us section at www.integrashieldfinancial.com. Remember to choose your process wisely.

It does not matter in the life of a child how much money you have in your bank account or really how fancy of a home you may live in. What matters most to that child is the quality time that two loving and caring parents can give that child. I will also say being the father of three adult children this does not change with age at least not with my kids.

Ten or twenty years from your divorce the one thing you and your children will remember is how you and your spouse went through this most difficult time in your life. Ask yourself how you would like to have your children remember it. Did they feel trapped in the middle like many children of divorce or did you and your spouse work together to keep them front and center. Your kids will remember and so will you.

As a financial neutral and mediator, I use agendas to start meetings to give us a track to run on. Part of that agenda includes a section titled, “Let’s Have a Conversation People Before Numbers”. I explain that as people they are far more important than any numbers on a balance sheet or cash flow statement. Sometimes it is too easy to get so caught up in the numbers of divorce negotiations the couple forgets that they are living breathing human beings with needs, interests, feelings and emotions. Sure, the financial issues are important but I believe in putting people ahead of numbers.

Want to have successful divorce negotiations put yourself in the shoes of your spouse, which may be easier said than done. If you can do this, if you can put your spouse before the numbers, the numbers tend to work themselves out. Do this and not only you and your spouse will remember how you handled this most difficult time in your life, your children will too.

Allocating assets and liabilities between spouses is one of the financial pillars in any divorce. In my work as a financial neutral and also when working on behalf of an individual in a divorce the subject of credit card debt is often a topic that needs to be addressed. This is especially true when credit card balances are not paid in full each month.

The usual credit card ownership arrangements are joint or individual. There is another form of credit card ownership when one spouse is the primary account holder and the other spouse is an authorized user. In this situation, both spouses have a card on the same account issued in their individual name.

The thorny part of this is the primary account holder controls the decision-making authority relative to the account. The primary account holder can close the account. The authorized user generally is not able to close the account. However if the primary account holder defaults on the account the card issuer will seek payment from the authorized user. Does not seem quite right, does it? As an authorized user, you are unable to close the account yet if the primary account holder does not make payments, the authorized user can be liable for payment. What can you do to protect yourself?

Here are 5 suggestions:

- First, run a credit report on yourself from all three major credit-reporting agencies. These agencies include Equifax, TransUnion, and Experian. The best place to obtain this report is from www.annualcreditreport.com . Your report is free from this site and they will not solicit you for other purchases with one exception. Please note these reports do not include your credit score. You can obtain your score if you like for a nominal fee.

- Once you have the report from each of the three reporting agencies review all three reports carefully. The report will tell you if you own the card jointly, individually, or if you are an authorized user. This is a great time to verify the accuracy of all the data contained in the report.

- If you have a card issued in your name that for some reason does not appear on your credit report, call the issuer to determine your ownership status.

- If you are listed as an authorized user on any credit cards, call the issuer to determine how you can be removed.

- Let your attorney know you want any authorized user status clearly dealt with in your negotiations with your spouse. You do not want this thorny issue sneaking up on you down the road. In collaborative divorces, a well-trained financial neutral and the attorneys representing their clients are well aware of this issue.

Your divorce, regardless of process will not be free. While a free divorce is impossible you can self manage many of the costs of your divorce. In my work as a financial neutral working with couples and individuals going through divorce there are five key tips I have observed that can help clients reduce the financial and emotional costs of divorce.

Do everything possible to minimize conflict with your spouse

Divorce is not without conflict. Conflict is expensive. The greater the conflict between you and your spouse the more your divorce will cost in terms of money and in terms of emotional wear and tear. If you and your spouse can openly and respectfully discuss what you can agree to and seek help to work through the issues where you have differing opinions the financial and emotional costs can be reduced. You will save money and time when you put your heads together to resolve your differences instead of butting them against each other.

Get organized and be prepared

If possible, work together with your spouse to gather all financial records necessary for any divorce process. This includes but is not limited to statement copies for everything you own and everything you owe to someone, tax returns including W-2’s, paycheck stubs, bank accounts, credit card accounts, retirement accounts, other investment accounts, insurance information, mortgage and other loans, and information concerning employer provided benefits. Consider putting together a 3-ring binder or electronic file folders containing each of these items. Your divorce decree requires the itemization of every asset and liability. It is foolish, costly, and to your detriment to not be fully open and transparent with your spouse. Being organized, open and completely transparent will help reduce costs.

Establish and communicate expectations

Communicate clearly with the professionals you are working with while at the same time listening carefully to the professionals you do engage. Consider this a two-way dialogue and recognize that you probably do not know what you do not know. Your divorce professionals have the expertise and wisdom to guide you through this difficult time. The wise professionals want to do this in a timely and cost effective manner. Beware of the so-called professionals who promise to get you the best deal. Best deals come at a price both financially and emotionally.

Identify your needs and interests, and those of your spouse

Whenever possible discuss these with your spouse in an open and respectful manner recognizing each of you will have unique needs and interests. You and your spouse will also have shared needs and interests. Needs and interests are not positions. Needs and interests are the underlying reasons and factors why something may be so important to you or your spouse. A position is more like a demand or a must have without stating any particular reasons. If your spouse seems locked into a position, ask them why this particular issue is so important to them and listen carefully for the underlying reasons. If you can find a way to satisfy those reasons, you are on the road to resolution.

Collaborate, compromise, and cooperate

Ask yourself, if you make every decision a battlefield how do you think your spouse will respond. Drawing lines in the sand will only isolate you and make it harder to reach agreements not to mention cost a lot more money and take more time. Remember you got married together and you and your spouse will get divorced together one way or the other. You and your spouse get to choose how.

Every divorce and family is unique and comes with its own set of circumstances. The complexity of the relational, financial, and legal issues of your divorce along with the ability of you and your spouse to follow these five tips will ultimately determine how long your divorce will take and how much it will cost.

Choose your process and your professionals wisely. Check out this link to learn more and find out if a collaborative divorce is right for you. For more information and resources check out my website under the about us section at www.integrashieldfinancial.com. There you will find a video featuring actual collaborative divorce process clients, a divorce knowledge kit, resources for those with children, and a link labeled Collaborative Divorce with Dignity and Respect.

Your divorce, regardless of process will not be free. While a free divorce is impossible you can self manage many of the costs of your divorce. In my work as a financial neutral working with couples and individuals going through divorce there are five key tips I have observed that can help clients reduce the financial and emotional costs of divorce.

Do everything possible to minimize conflict with your spouse

Divorce is not without conflict. Conflict is expensive. The greater the conflict between you and your spouse the more your divorce will cost in terms of money and in terms of emotional wear and tear. If you and your spouse can openly and respectfully discuss what you can agree to and seek help to work through the issues where you have differing opinions the financial and emotional costs can be reduced. You will save money and time when you put your heads together to resolve your differences instead of butting them against each other.

Get organized and be prepared

If possible, work together with your spouse to gather all financial records necessary for any divorce process. This includes but is not limited to statement copies for everything you own and everything you owe to someone, tax returns including W-2’s, paycheck stubs, bank accounts, credit card accounts, retirement accounts, other investment accounts, insurance information, mortgage and other loans, and information concerning employer provided benefits. Consider putting together a 3-ring binder or electronic file folders containing each of these items. Your divorce decree requires the itemization of every asset and liability. It is foolish, costly, and to your detriment to not be fully open and transparent with your spouse. Being organized, open and completely transparent will help reduce costs.

Establish and communicate expectations

Communicate clearly with the professionals you are working with while at the same time listening carefully to the professionals you do engage. Consider this a two-way dialogue and recognize that you probably do not know what you do not know. Your divorce professionals have the expertise and wisdom to guide you through this difficult time. The wise professionals want to do this in a timely and cost effective manner. Beware of the so-called professionals who promise to get you the best deal. Best deals come at a price both financially and emotionally.

Identify your needs and interests, and those of your spouse

Whenever possible discuss these with your spouse in an open and respectful manner recognizing each of you will have unique needs and interests. You and your spouse will also have shared needs and interests. Needs and interests are not positions. Needs and interests are the underlying reasons and factors why something may be so important to you or your spouse. A position is more like a demand or a must have without stating any particular reasons. If your spouse seems locked into a position, ask them why this particular issue is so important to them and listen carefully for the underlying reasons. If you can find a way to satisfy those reasons, you are on the road to resolution.

Collaborate, compromise, and cooperate

Ask yourself, if you make every decision a battlefield how do you think your spouse will respond. Drawing lines in the sand will only isolate you and make it harder to reach agreements not to mention cost a lot more money and take more time. Remember you got married together and you and your spouse will get divorced together one way or the other. You and your spouse get to choose how.

Every divorce and family is unique and comes with its own set of circumstances. The complexity of the relational, financial, and legal issues of your divorce along with the ability of you and your spouse to follow these five tips will ultimately determine how long your divorce will take and how much it will cost.

Choose your process and your professionals wisely. Check out this link to learn more and find out if a collaborative divorce is right for you. For more information and resources check out my website under the about us section at www.integrashieldfinancial.com. There you will find a video featuring actual collaborative divorce process clients, a divorce knowledge kit, resources for those with children, and a link labeled Collaborative Divorce with Dignity and Respect.  Getting unmarried and taxes can become a consideration in terms of whether to have a divorce final by year-end or final after January 1. I have worked on a number of divorce cases where this very topic deserved a thorough analysis to determine which tax filing year to have the divorce final.

Here are a couple of important points to remember. If you are married for the entire year, the choices you have for tax filing are joint or married filing separately. If the courts deem the divorce final no later than December 31, you are considered divorced for the entire year and are not able to file jointly or married filing separately. An entry of divorce on December 31 requires filing as single or if qualified as head of household for the year ended December 31.

How do you determine which year is best? Usually this requires completion of the various tax return scenarios by a qualified tax advisor normally a CPA or Enrolled Agent. They will run the numbers for a joint return as if the couple was married the entire year. Next, they will run the numbers as if they were divorced for the year with either a single or Head of Household filing status if qualified. Whatever method results in the lowest combined tax for the couple preserves more of the family assets and resources. Sometimes this can amount to thousands of dollars.

I recently concluded a collaborative divorce case as a financial neutral for a couple where this very issue came up. My initial analysis revealed the couple could in-fact save thousands of dollars by having the divorce final by year-end vs. filing a joint return for 2014 and the divorce final in 2015. A thorough and complete analysis by a CPA confirmed the couple would save approximately $20,000 in income taxes by having the divorce final no later than December 31.

Needless to say, this couple would much rather have the $20,000 in their pockets vs. having to forfeit that amount to the I.R.S. Although divorce documents are e-filed with the courts, there is no guarantee the divorce will be final by December 31. Once the documents are received by the courts, the file is assigned to a judicial officer for review. Files submitted in late November and December are not automatically reviewed and approved by year-end. Attorneys working on the case will often make requests to have the review and entry of divorce completed by December 31. I hope that in this most recent case it will be. It is always worth a try especially when you have $20,000 on the table.

Do not overlook the tax strategies and any potential savings when divorcing near year-end. It could potentially save you and your family a bundle.

Getting unmarried and taxes can become a consideration in terms of whether to have a divorce final by year-end or final after January 1. I have worked on a number of divorce cases where this very topic deserved a thorough analysis to determine which tax filing year to have the divorce final.

Here are a couple of important points to remember. If you are married for the entire year, the choices you have for tax filing are joint or married filing separately. If the courts deem the divorce final no later than December 31, you are considered divorced for the entire year and are not able to file jointly or married filing separately. An entry of divorce on December 31 requires filing as single or if qualified as head of household for the year ended December 31.

How do you determine which year is best? Usually this requires completion of the various tax return scenarios by a qualified tax advisor normally a CPA or Enrolled Agent. They will run the numbers for a joint return as if the couple was married the entire year. Next, they will run the numbers as if they were divorced for the year with either a single or Head of Household filing status if qualified. Whatever method results in the lowest combined tax for the couple preserves more of the family assets and resources. Sometimes this can amount to thousands of dollars.

I recently concluded a collaborative divorce case as a financial neutral for a couple where this very issue came up. My initial analysis revealed the couple could in-fact save thousands of dollars by having the divorce final by year-end vs. filing a joint return for 2014 and the divorce final in 2015. A thorough and complete analysis by a CPA confirmed the couple would save approximately $20,000 in income taxes by having the divorce final no later than December 31.

Needless to say, this couple would much rather have the $20,000 in their pockets vs. having to forfeit that amount to the I.R.S. Although divorce documents are e-filed with the courts, there is no guarantee the divorce will be final by December 31. Once the documents are received by the courts, the file is assigned to a judicial officer for review. Files submitted in late November and December are not automatically reviewed and approved by year-end. Attorneys working on the case will often make requests to have the review and entry of divorce completed by December 31. I hope that in this most recent case it will be. It is always worth a try especially when you have $20,000 on the table.

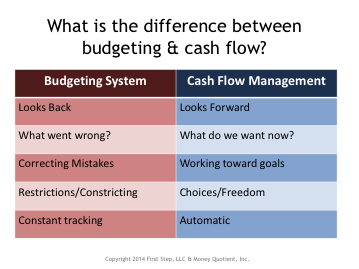

Do not overlook the tax strategies and any potential savings when divorcing near year-end. It could potentially save you and your family a bundle.  I teach a cash flow planning course throughout the metro area. One of the ways I begin, is by asking everyone to tell me the first word that comes to mind when they hear the word budget? Often it is a negative type of word like restricting, confining, or boring. When I ask a similar question about cash flow, common responses are future and choice. The chart below illustrates some of those differences.

I teach a cash flow planning course throughout the metro area. One of the ways I begin, is by asking everyone to tell me the first word that comes to mind when they hear the word budget? Often it is a negative type of word like restricting, confining, or boring. When I ask a similar question about cash flow, common responses are future and choice. The chart below illustrates some of those differences.

Money is one of those issues often cited as a reason for divorce. I would offer that money itself does not cause divorce. How spouses handle money differently and an inability to recognize their different money personalities and learn effective ways to work through those differences can lead to divorce or at least cause significant strain in a marriage.

Establishing reasonable and necessary future living expenses post-divorce is one of the two pillars of any divorce process. Both spouses will need to establish their own living expenses independently of one another. If money was a source of conflict in the marriage, imagine the conflict that exists during the divorce process. The reality is the money conflict can and often does escalate in divorce. In my work as a financial neutral, financial mediator, and financial planner, I work with you and your spouse to help you focus on your future.

One approach to creating a future oriented cash flow plan for your post-divorce life is to add up all of your expenses necessary for your basic living needs. This would include things like housing, food, clothing, and medical care to name a few. If you are familiar with Maslow’s hierarchy of needs, this would be the lower level (safety and security) in the hierarchy. Keep in mind that at this basic level food does not include dining out. Clothing does not include upscale designer clothing. Items in this safety and security level are for basic needs.

After taking care of basic needs you can then address expenses that you have total control and choice over such as dining out, entertainment, cash spending money, gifts, personal care, etc.

Finally, you may want to consider future goals and needs like retirement, creating an emergency savings plan, a different automobile, or an education.

Think of separating these expenses into three different categories. I ask my clients to visualize these as three distinct buckets. The buckets are one for basic needs, two control and choices, and three future needs and wants. It is important to recognize that during and after the divorce, you may need to at least temporarily forgo some if not all of the future needs and wants, and substantially minimize the control and choice buckets due to the initial financial strain of divorce.

It is equally important to recognize this time-period does not necessarily last forever. Incomes can and do increase over time and some expenses such as child-care reduce and ultimately disappear at some point.

A well-developed future oriented cash flow plan can give you the peace of mind to know you will be financially secure. It can give you the opportunity to choose what is important to you about money, prioritize your goals, and create a solid model and roadmap for your life ahead. A financial neutral in collaborative divorce process will help you create this type of plan.

A short three-minute video on the history of cash flow and money management is available by clicking here.

Money is one of those issues often cited as a reason for divorce. I would offer that money itself does not cause divorce. How spouses handle money differently and an inability to recognize their different money personalities and learn effective ways to work through those differences can lead to divorce or at least cause significant strain in a marriage.

Establishing reasonable and necessary future living expenses post-divorce is one of the two pillars of any divorce process. Both spouses will need to establish their own living expenses independently of one another. If money was a source of conflict in the marriage, imagine the conflict that exists during the divorce process. The reality is the money conflict can and often does escalate in divorce. In my work as a financial neutral, financial mediator, and financial planner, I work with you and your spouse to help you focus on your future.

One approach to creating a future oriented cash flow plan for your post-divorce life is to add up all of your expenses necessary for your basic living needs. This would include things like housing, food, clothing, and medical care to name a few. If you are familiar with Maslow’s hierarchy of needs, this would be the lower level (safety and security) in the hierarchy. Keep in mind that at this basic level food does not include dining out. Clothing does not include upscale designer clothing. Items in this safety and security level are for basic needs.

After taking care of basic needs you can then address expenses that you have total control and choice over such as dining out, entertainment, cash spending money, gifts, personal care, etc.

Finally, you may want to consider future goals and needs like retirement, creating an emergency savings plan, a different automobile, or an education.

Think of separating these expenses into three different categories. I ask my clients to visualize these as three distinct buckets. The buckets are one for basic needs, two control and choices, and three future needs and wants. It is important to recognize that during and after the divorce, you may need to at least temporarily forgo some if not all of the future needs and wants, and substantially minimize the control and choice buckets due to the initial financial strain of divorce.

It is equally important to recognize this time-period does not necessarily last forever. Incomes can and do increase over time and some expenses such as child-care reduce and ultimately disappear at some point.

A well-developed future oriented cash flow plan can give you the peace of mind to know you will be financially secure. It can give you the opportunity to choose what is important to you about money, prioritize your goals, and create a solid model and roadmap for your life ahead. A financial neutral in collaborative divorce process will help you create this type of plan.

A short three-minute video on the history of cash flow and money management is available by clicking here.